Georgia’s capital markets primed for influx of int’l investment following new rules and regs

As Georgia’s State Pension Fund has launched, a whole raft of new rules and regulations are readying Georgia’s capital markets for an increase in business, both domestic and foreign.

As Georgia’s State Pension Fund has launched, a whole raft of new rules and regulations are readying Georgia’s capital markets for an increase in business, both domestic and foreign.

A multipronged package of measures is being targeted at encouraging lari funding, helping cut back dollarization, reducing currency and interest rate risks for banks, companies and investors and increasing investor protection.

The laws also aim to enable Georgian banks to gain a foothold in global markets and help bring money into the country.

The International Monetary Fund (IMF) has applauded the National Bank of Georgia (NBG)’s strategy to “engage with foreign investors through an investor relations office and road shows.”

The ground has been prepared with new Georgian laws, says the NBG “in compliance with the best international practice” and “based on relevant European Union (EU) directives and regulations”. The new legislation on investment funds, it believes, “creates an attractive and competitive foundation for fund business development in Georgia.” As it stands now, there is little any fund business at all.

Such progress in the development of capital markets will help Georgia present a good case to analysts at international rating agencies to back up the strong growth prospects story. All three have been steadily upgrading Georgia over the last couple of years, so the country is now not too far off from achieving investment grade – 2025 is suggested in the markets – which indicates an acceptable level of risk for major international funds.

The hope is that these measures, as well as the major new investor in the form of the State Pension Fund, will encourage more players to join in Georgia’s markets.

At TBC Capital, the view of the research team is that “there is room for new investment vehicles. In most cases, demand on issuances is oversubscribed, indicating high demand for Georgian bonds…We believe that new issuances could stimulate secondary trading and increase market liquidity.”

Brokers Galt & Taggart predict that with 500 million GEL ($173 million) in its coffers already, the Pension Fund will accumulate 4.8 billion GEL ($1.6 billion) by 2025.

“Currently half this amount is deposited in commercial banks, while the rest is in the National Bank (NBG). The pension proceeds are expected to be invested in local treasuries (government bonds) from 2020 and gradually expand to Georgian Eurobonds and local corporate bonds. The fastest growing category is expected to be GEL-denominated local corporate bonds and treasuries, as the emergence of a large institutional investor (the State Pension Fund) will increase demand.”

However, with Georgia’s corporate sector need for very considerable sums of money to develop energy production, agriculture and industry, more than the State Pension Fund’s investment resources are required.

Galt & Taggart adds: “The Pension Fund has a 10 percent limit on investing in local corporate bonds of a single issuer, and we expect that to be a major obstacle for local corporate bond development.”

January 2020 kicked off with the NBG announcing a long-heralded law that creates a framework for derivatives – financial contracts used worldwide to manage risks. A lot of heads have been put together on this, with the European Bank of Reconstruction and Development (EBRD) and the International Swaps & Derivatives Association working with the NBG. Also pulled in, through workshops, were potential local users.

“Banks currently do cross-border derivatives, but volumes are limited and prices are high. Without netting arrangements in place, banks have to allocate capital on gross exposure. This changes with the new law,” explained the NBG.

“Corporates: they too have exposures to currency and interest rate risks. Especially exporters and importers. They are going to be active consumers of derivative products. Their counterparties are usually banks. When banks enter into derivatives with corporates, they may be exposed to additional risks. That risk is usually hedged with other banks in the market. Again, the costs of hedging are priced into products offered to corporate clients”, the NBG added.

As described in detail by the EBRD, January’s package “provides for the enforceability of derivatives transactions, including netting, close-out netting and financial collateral, amends a number of laws and reinforces key related concepts, such as settlement finality.” It allows “companies to safely and efficiently hedge their risks and exposure, including from foreign exchanges and interest rates, contributing to the development of a local currency financial market.”

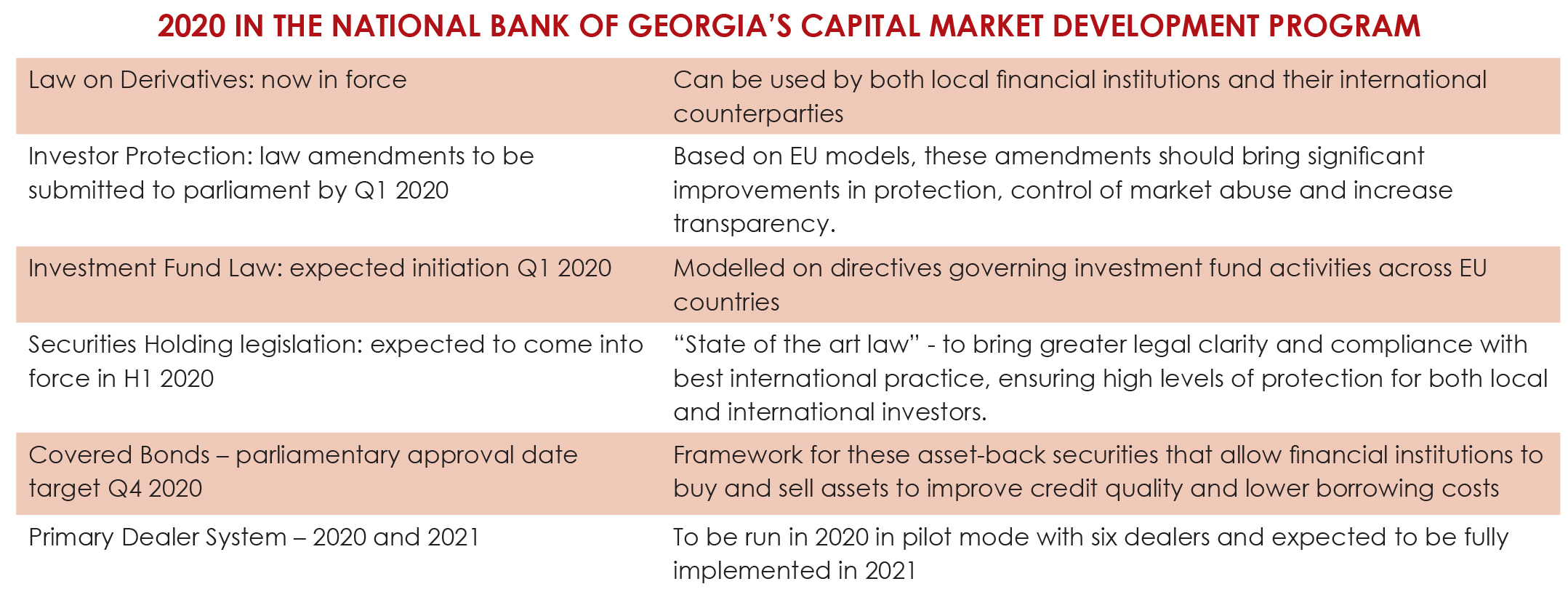

In the pipeline are laws to improve investor protection and investment transparency, to provide new forms of securities (covered bonds) and make bond pricing more efficient. The IMF has listed, with approval of the pace of progress in developing the markets, “a roadmap to introduce a Primary Dealers system (in which dealers act as wholesalers for the National Bank) that will help deepen the market and diversify the investor base.”

Georgia is making up for lost time. Even the NBG admitted last year that Georgia’s bond market (corporate and government) “is relatively small compared to its peers” and that includes even neighbouring countries. It added: “The lack of liquidity in the secondary market and the relatively small size of the issues remain constraints for foreign investors.”

Another concern, outlined in the NBG’s 2019 Financial Stability Report, was that much corporate debt “is foreign currency-denominated which businesses find difficult to hedge. There has also been considerably reliance on short-term funding, which would pose rollover risks should financial conditions tighten.”

Government advisors Berlin Economics have commented that “larger companies…lack long-dated currency debt instruments and risk-orientated capital” because of the “underdeveloped bond and equity markets”.

The extent of dollarization, still at the relatively high level of 56 percent of loans and 62 per cent of deposits “results in vulnerabilities” says Berlin Economics’ Dr. Alexander Lehmann. These include credit and liquidity risks. His concern was shared by IMF managing director Christine Lagarde on her visit in 2019, and she pointed to solutions such as “developing the local capital market and promoting institutional investors who could support demand for long-term, local-currency bonds and other financial assets.”

These concerns are being addressed.

Foreign investor interest in Georgia’s markets has been rising, but for the less risky government treasury rather than corporate bonds, and non-residents hold 10 per cent (as of December 2019) of treasuries outstanding.

Galt & Taggart expect their attraction to continue. “The increased interest of non-residents recently can be explained by high interest rates in GEL while in the US and other advanced economies, rates remain low. As there will be little room for a sizable rate cut in 2020 given inflation dynamics in Georgia, we expect interest rates will remain high in GEL and Georgian treasuries will remain competitive.”

Still to come? According to Dr. Alexander Lehmann: “Innovations such as inflation-linked bonds and green bonds could further widen funding. Liquid equity markets are a more ambitious aim – private equity rather than listed stocks and IPOs should be the priority.”