Banking regulations revisited – NBG eases lending requirements

New lending regulations going into effect April 15, 2020 aim to create some wiggle room for banks to expand their lending activities and provide relief for households looking for mortgages.

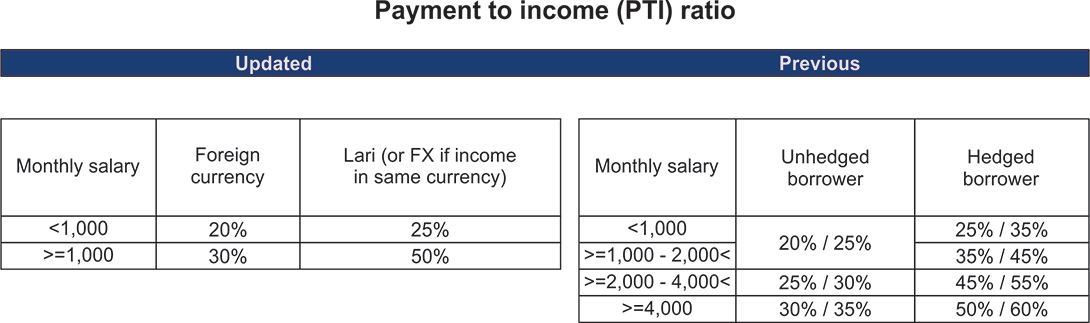

The new regulations follow on the tail of changes that came into force in January 2019, which set stringent limits on the ability of banks to make loans in dollars, on PTI (payment-to-income) ratios for loans and on effective interest rates.

These restrictions have brought some undoubted benefits for consumers. One big benefit is that by forcing people to take local currency debt, the national bank regulations have protected consumers from the recent GEL devaluation. This has turned out to be more important than even the National Bank could have expected, since (at time of printing) dollarised loans have seen their local currency repayments go up by 20% since January 2019. Earlier this month, that increase briefly hit 30%.

Nonetheless, recent changes mean that banks will be able to grant loans with substantially higher PTIs and flexibility.

The other important changes slated for mid-April include:

● Financial institutions will have increased leeway in determining a borrower’s complete income

● Mortgage maturity limits will increase from 15 to 20 years

● Corporate governance requirements will be introduced for commercial banks and microfinance institutions.

The National Bank of Georgia introduced the 2019 regulations in a measure to counter foreign currency over-indebtedness in the country (the household debt to GDP ratio had risen from 10.6% in 2011 Q1 to 36% in 2018 Q4), to prevent what it said were predatory lending practices at the time and to encourage the process of de-dollarization.

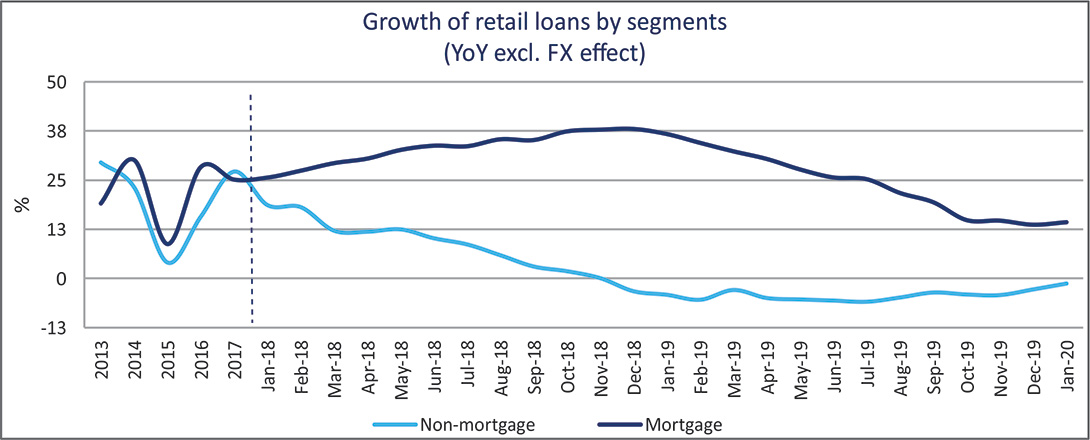

As predicted, the first four months of 2019 saw a cool down, with year-on-year growth across retail, SME and corporate loans shrinking, demonstrated in the graph below.

Microfinance organizations also felt the squeeze, and experienced net losses of 79 million GEL in H1 of 2019.

Though lending across most portfolios picked up again in April and more so in the third quarter of 2019, calls for lighter regulation have continued to resound in the Georgian banking, construction, real estate development and business communities, as growth has been slow.

Prime Minister Giorgi Gakharia himself urged Finance Minister Ivane Matchavariani in November 2019 to consider decreasing the GEL ceiling from 200,000 to 100,000.

Head economist of TBC Bank Otar Nadaraia says that overall, the lending restrictions have not ended in drastic downturns for banks, and lending has picked up because of competition and banks’ willingness to lend at lower margins, however:

“The situation is still not great for the market. The [earlier] regulations created a large informal mortgage market, in which people can now get quasi-loans from developers, which is problematic because this market is nowhere near as regulated as the banking sector. This further jeopardizes consumers, and pushes them into loans that may be more expensive than what they could have gotten at banks before.

Nadaraia suggests a middle-ground be sought between the ease of the pre-2019 regulations and the stringency of what has followed since.

“A rational approach would be something in the middle: multi-currency lending. You could mandate half the

loan be denominated in GEL. From a risk management perspective, this is effective, and it would allow the banking sector to reclaim some of the business that has gone into the informal market.”

Time will tell how much lending availability will be created for borrowers by this round of easing of lending regulations, but one positive that banks have already identified is less procedural headaches.

TBC CEO Vakhtang Butskhrikidze says the new regulations will ease the burden on operations: “The important thing is that we are moving away from a rules-based approach towards a principles-based approach. For example, when it comes to the self-employed, we ourselves will determine the formulation of how to extend a loan. Of course, we will agree on these principles with the National Bank.”