TBC Capital predicts slow but steady economic recovery

Summer’s finally here but coronavirus is still in the air. Hopes that the heat and sunshine would damper the spread of the virus have proved largely unfounded, as some countries witness or teeter on the edge of a second wave.

Fortunately, this is not the case in Georgia, where case numbers have been maintained in the lower single digits through aggressive quarantining and contact tracing, and thanks to which the economy has had the opportunity to open up to a fairly large degree – in some cases weeks ahead of the government’s initial plan to reopen.

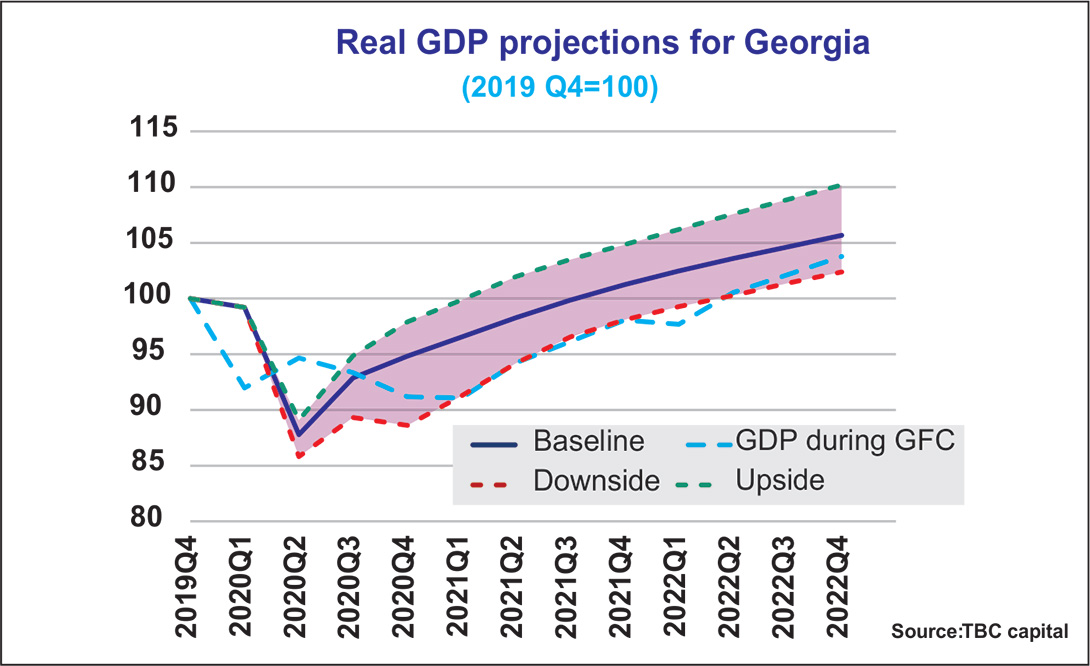

However, like countries the world over, Georgia is in for the long economic recovery slog, with TBC Capital’s June report predicting the country will return to indicators from the end of 2019 only sometime in the second half of 2021, pending the production and widespread distribution of an effective vaccine and maintained adequate healthcare.

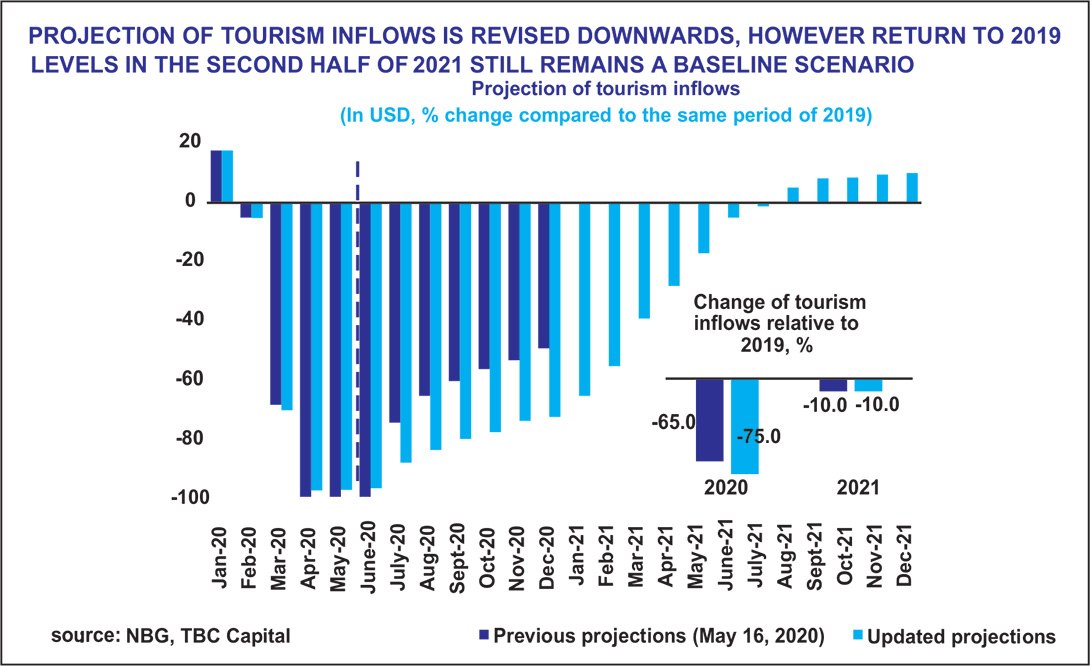

In its June edition of COVID-19: Tracking the Recovery, TBC Capital revised downward its projections for tourism inflows, and may have to do so even further after the government ruled to keep Georgia’s borders shut, reasoning that not many people are willing to travel at the moment, and those that do may bring the virus with them.

TBC Capital predicts tourism inflows will remain down year-year-on as much as -75% and will only begin to surface with less than 10% growth come August 2021.

This is much in part due to the COVID-19 situation in surrounding states:

“Georgia’s main source of visitors remains its neighboring countries – Armenia, Azerbaijan, Russia and Turkey. Except for the latter, the epidemiological situation in these countries remains serious and there has been a higher than predicted spread of the virus. Traditionally, these countries have supplied the bulk of tourism traffic in peak months. As for ‘green corridors’ with EU states, currently the bilateral opening of the borders has only been negotiated with France, Germany, Lithuania, Latvia and Estonia. These countries supplied just 2% of total visitors in 2019”, TBC Capital’s Head of Research Tornike Kordzaia says.

“True, options for European travelers are currently limited, with only 15 countries outside EU deemed to be safe, but on the other hand, Georgia will have shed some of its competitiveness as a cheaper travel destination as hotel prices are down everywhere, not just here. Most desti-nations are incredibly cheap right now, and they are all vying for a small number of tourists”, Kordzaia notes. “What helps, is our well-earned reputation as a safe-haven, and a serious effort has to be made to reinforce this positioning”.

Lastly, even with strong positioning and marketing, tourist traffic from the EU would not fill in the gaps: in 2019, revenue generated from travelers from the EU accounted for a bit less than 15% of revenue generated that year.

“Even if twice as many travelers come in from Europe in August as they did last year, it cannot plug the hole entirely”, Kordzaia notes, “Given the current price discounts, attracting more domestic visitors is an opportunity. In 2019, Georgian residents spent a total of 2.3 million nights in foreign hotels. In addition, a total of 24.5 million nights were spent by domestic tourists, either in own, or friends’ and relatives’ apartments and houses. Swaying these people towards the formal accommodation sector is an opportunity.”

Tough times are in store for Georgia in 2020 beyond tourism as well, when TBC Capital predicts the economy will contract by 4.5% – 5.5% before recovering by 5% – 6% in 2021. The next few months will be choppy before achieving a degree of stability.

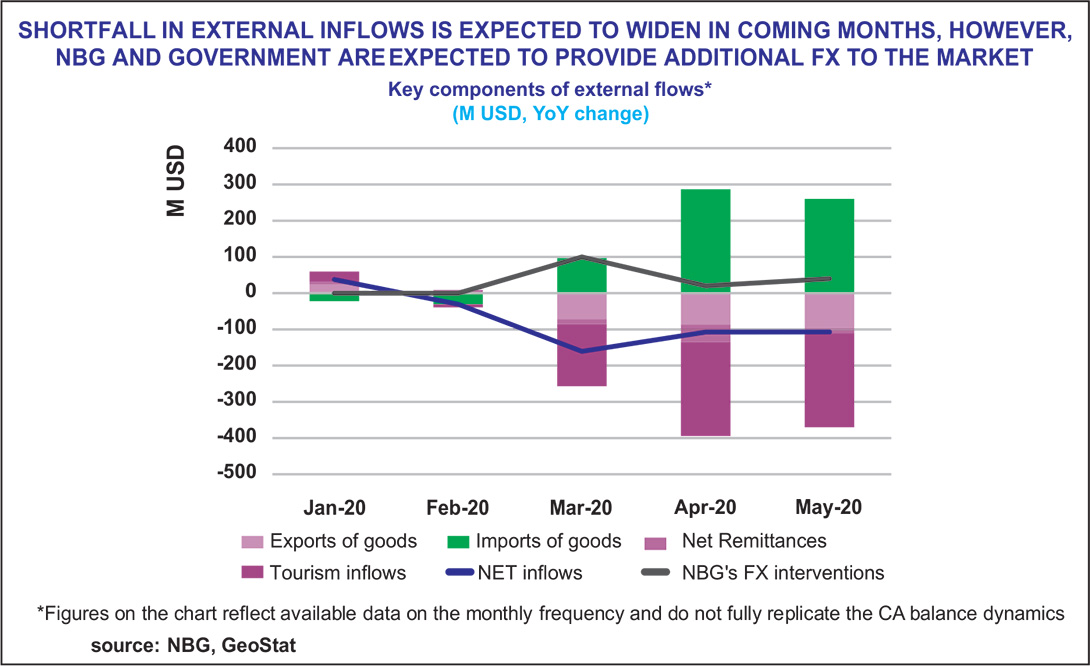

The disparity between net flows is expected to rise in the coming months in favor of outflows, which were initially offset by a sharp decline in imports during the shutdown which cushioned the initial negative impact. However, looking forward, the recovery of imports is expected to be faster than that of inflows (exports), which could further worsen the net impact. It is expected the NBG and government will provide additional foreign currency to the market when needed, and together with around USD 1.7 bn additional funding secured by the government and the NBG, the floor on net international reserves has been lowered to allow the central bank to more actively intervene on the FX market.

As a result of these dynamics, TBC Capital writes, the Georgian lari (GEL) will likely gravitate towards the exchange rate of 3.0 GEL in the second half of the year.

“People have started consuming more again since the economy has opened up, which means we can likely expect some pressure on the GEL exchange rate in August or September as im-ports rise, and thus the demand on foreign currency”, Aleqsandre Bluashvili, Head of Macro-financial analysis of TBC notes, but points out that after this change is factored in, the lari is likely to stabilize.

“The dollar has already strengthened against most neighboring currencies to the extent that one could expect. It is unlikely to strengthen more, and so looking forward it will be a question of the Georgian lari real effective exchange rate moving back towards its long-term equilibrium point” Bluashvili notes.

The report highlights some positive trends:

While the budget deficit projection has been revised upwards by more than 5% of GDP due to emergency expenses, TBC Capital says a significant portion of the funds Georgia has borrowed from IFIs has created a solid emergency buffer in case there is a second deterioration in the epidemiological situation, though TBC Capital does not see a major second wave as in its baseline scenario.

Inflation, initially affected by the sharp move of the GEL as well as one-off cost push factors due to COVID-19 regulations, also seems to be stabilizing. TBC Capital predicts inflation will sink from 6.5% in May to hit 4.5% by the end of the year due to the stability of the GEL and reduced economic activity.

Meanwhile, the development sector is looking forward to the government support plan boosting sales – by nearly 10% year-on-year, TBC Capital predicts. The 434 million lari support plan includes a mortgage interest rate subsidy as well as the acquisition of residential properties for IDP households. While real estate may still be in for a difficult year with a circa 20% decrease in transactions and around a 10% decline in prices, TBC Capital expects demand to return in 2021, with the number of transactions hitting 2019 levels and prices just 5% less than those of 2019, and the market recovering to and exceeding 2019 indicators by 2022.

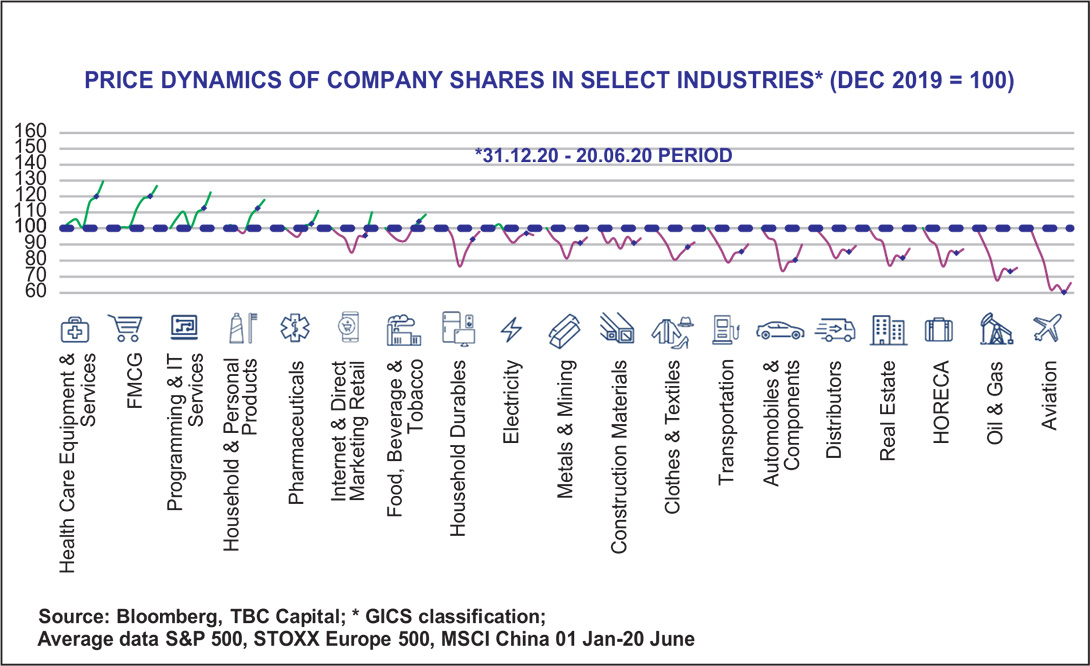

Other sectors in for difficult times ahead remain HORECA, automobiles and transportation. Meanwhile, sectors like FMCG and pharmacy have displayed a resilience to pandemics so far, while others like durable goods’ retail and construction materials, have displayed recoveries at different tempo.