TBC Capital’s macro insights: ‘still restart rather than recovery’

TBC Capital’s macro insights report from mid-March points to a slow reassembly of the pieces in 2021, but retains optimism for 2022 and beyond. A delayed start to mass vaccination in Georgia and slow tourism inflows are likely to hinder the recovery process, while still sufficient external financing and the NBG’s cautious stance amid close to, or even above, tolerance level infla-tion will provide some stability on the exchange rate front.

Vaccination

While the EU, US, Israel and Turkey head for achieving herd immunity in 2021, Georgia may be looking at reaching that threshold only in Q2 2022, TBC Capital’s new macro insights report from mid-March notes.

Depending on the efficacy of the vaccine used in the wide-spread immunization program, and considering the number of people who have already recovered from the virus, Geor-gia will need around 45%-63% vaccine coverage to reach this threshold.

Unfortunately, Georgia is looking at an uphill battle, as the public’s take on vaccination remains negative.

Tourism

Despite the delayed inoculation program, tourism levels in Georgia in 2021 are set to recover by 25% compared to 2019, followed by a 90% recovery in 2022, if regular flights are to resume.

However there are reasons to confidently look forward to the revival of the tourism industry, the TBC Capital report points out: the strong 20% pre-pandemic growth of inflows in 2019 despite the Russian flight ban; the low share of long-dis-tance and business trips in Georgia’s tourism structure; the high share of repeat visits; the relatively young age of visitors and an abundance of open-air tourism destinations are all factors which will reliably prop up the tourism sector.

Pent-up demand will also likely play a role in getting tourism back on its feet. This was visible in other countries last summer – once they reopened, albeit temporarily, the tourism industry recovered fast.

However, due to the delay in the vaccination campaign, a gradual reopening is favorable as the risks of a resurgence of the virus and strict lockdowns remain high, TBC Capital writes.

Growth of Inflows, Strengthened Trade Balance

Not all inflows have come to a screeching halt, the TBC Capital report notes. Some have even displayed resilience: namely, in 2020, total exports decreased by 12.0% in USD terms while actually increasing by 3.5% if re-exports are excluded.

The main reason behind this is the fact that Georgia produc-es very few, if any, capital goods – demand for which has been subdued during the pandemic. Instead, Georgian exports have higher domestic value added in the production of essential goods, which have been more resilient during the crisis.

Remittance inflows also increased by 8.8% in 2020, includ-ing a strong, 15.7% year-on-year growth in the fourth quarter. Some of this increase was due to reduced cash inflows and increased digital transfers as a result of the closed borders. However, even after adjustment for this component, per TBC Capital estimates, remittance inflows increased by 5.0% in 2020, which is explained by strong household disposable income dynamics in most remitting countries on the back of unprecedented fiscal responses to the pandemic.

Alongside lower total inflows, re-exports and oil prices, coupled with a weaker GEL and diminished domestic demand, imports of goods dropped by 15.9% in 2020, leading to around a $1 billion improvement in the trade in goods balance.

Growth

Although January 2021 GDP growth came in at -11.5%, this decline was in line with expectations. As the low base effect comes into play and the non-tourism sector continues to perform relatively better, for the full year of 2021 TBC Capital expects around 4% growth.

This will be followed by around a 7.5% rebound in 2022, the main driver of which will be the almost-full recovery of the tourism sector.

As in 2020, household consumption supported by remit-tances, public current spending and grace periods on credit, is going to be strong and will lead growth in 2021 before net exports turn positive and investments also recover substan-tially (the latter increasing only marginally in 2021 due to still-sizable government capital spending coupled with the low base effect).

GEL Exchange Rate

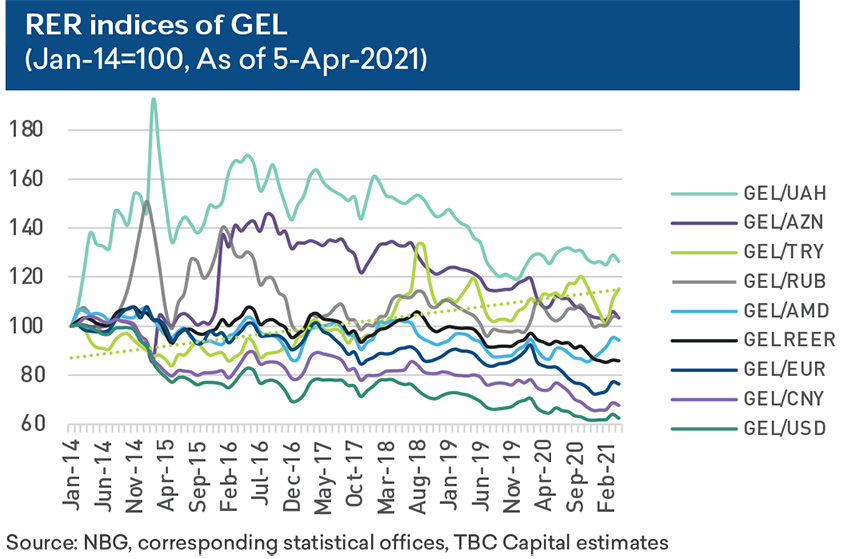

As for the GEL, the real effective exchange rate has weak-ened substantially and remains well below both its long-term trend and medium-term average.

However, an important question is whether the dynamics of bilateral exchange rates should also be taken into account. In other words, trade partners’ currencies can have a detrimental impact on competitiveness, due to the higher elasticity of trade to the exchange rate compared to other partners’ currencies. Thus, looking at the overall real effec-tive exchange rate may be misleading.

When looking at bilateral exchange rates, the GEL has depreciated against almost all economic partner currencies, with the Turkish lira having strong recent depreciation and a substantial share in Georgia’s external trade.

At the same time, the TBC Capital report does not foresee competitiveness pressures arising from Turkey to be strong for the following reasons: first, the lira has already appreciat-ed back due to high inflation in Turkey and partially nominal appreciation. In fact, the GEL has an appreciation trend against the lira due to stronger GDP per capita and, conse-quently, productivity growth, and the lari/lira exchange rate may even be seen somewhat below its trend. This holds even after the end of March depreciation of Turkish lira.

Second, while there is some evidence of the lari/lira real exchange rate impacting Georgia’s trade balance with Turkey, this relationship has likely weakened recently. More importantly, in such episodes where a weaker lira was causing Georgia’s higher trade deficit with Turkey, the overall trade balance appeared not to have been impacted, meaning cheaper imports from Turkey were mainly compet-ing with other imports, rather than with domestic producers.

See more at www.tbccapital.ge and subscribe to our news-letter for more information: https://tbccapital.ge/?subscribe