G&T: what’s behind Georgia’s e-commerce boom?

The e-commerce market in Georgia has been one of the few to benefit from the otherwise debilitating effects of the Covid-19 pandemic.

Several lockdowns have introduced many to the ease of online purchasing for the first time, or increased the frequency of online purchasing for those already well-acquainted. Georgian companies meanwhile have also responded by expanding their online offerings.

In a recent mid-July report from Galt & Taggart, the brokerage looks at the dynamics of Georgia’s e-commerce sector today and makes several forecasts about what the market might look like by 2025.

E-commerce today

As a result of the Covid-19 lockdowns, e-commerce sales increased 3.2x y/y in 2020, and 5.4x in the first quarter of 2021.

Despite the recent high growth and the fairly even-paced expansion of the market in the years before Covid-19, the e-commerce penetration rate of retail sales remains low at 1.1%, far below the average of 12% in the European Union. A love of the shopping experience and the ease and speed of shopping in stores remains a disincentive to buying online.

However, the fairly high-paced growth in the sector is likely to continue, G&T notes, supported by an increasing number of users engaged in online shopping, growth in average annual spending per customer and local online retailers grabbing a larger share from cross-border online spending.

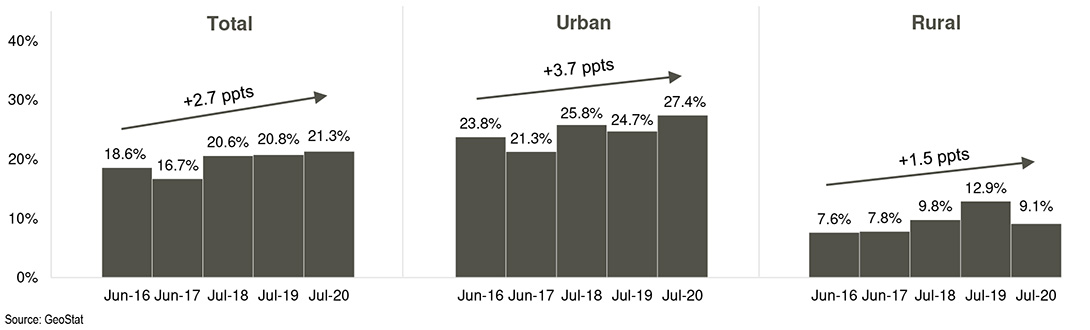

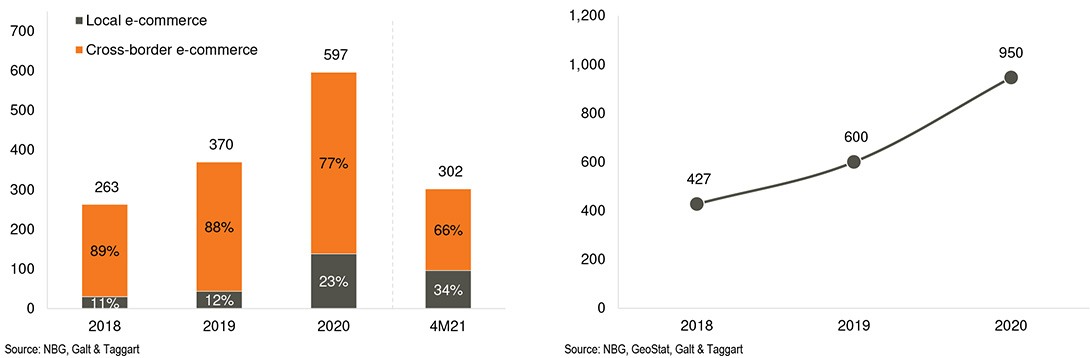

In 2020, more than 630,000 residents of Georgia (21% of adult population, 17% of total population) purchased goods worth 597 million GEL (193.5 million USD) online – this includes both local and cross-border spending on platforms such as Amazon and Alibaba. This equates to roughly 950 GEL in average annual spending per user. This is three times lower than that of European countries on average, G&T writes, adding that this number is expected to grow with the increasing purchasing power of Georgian households.

Meanwhile, local e-commerce platforms snagged just 23% of this activity.

The use of e-commerce platforms was far more prominent in cities than in rural areas: more than 27% of the urban population used e-commerce services in 2020, while this number was just 9.1% in rural areas.

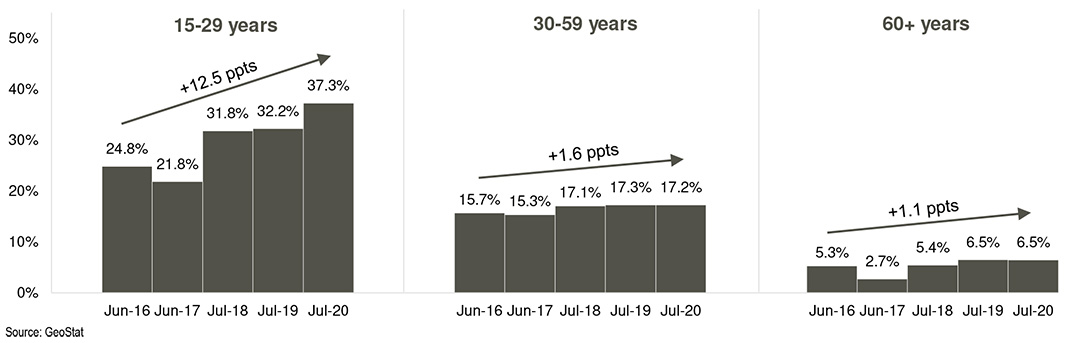

An interesting picture emerges when sorting users by age group, with more than 37% of the 15-29 y.o. group having made an online purchase in 2020 – a full 12.5 percentage points up from 2016.

Meanwhile, just a little over 17% of 30-59-year-olds and 6.5% of the 60+ population bought online in 2020, with just 1.1% growth over the entirety of 2016-2020.

Georgian shoppers overwhelmingly prefer international retailers, which grabbed about three-quarters of total e-commerce spending in 2020. However, Covid-19 forced local companies to increase their online presence as a result of which the share of local e-commerce more than doubled between 2018-2020, from 11% to 23%. By 2025, it is expected that local e-commerce will account for more than half of total e-commerce spending.

This will take place on the back of healthy expansion in the local market, G&T predicts, the size of which increased 3.2x y/y to 137.9 million GEL in 2020. This rate was 5.4x y/y in 1Q2021, and is a trend likely to continue even after the Covid-19 boost has worn off.

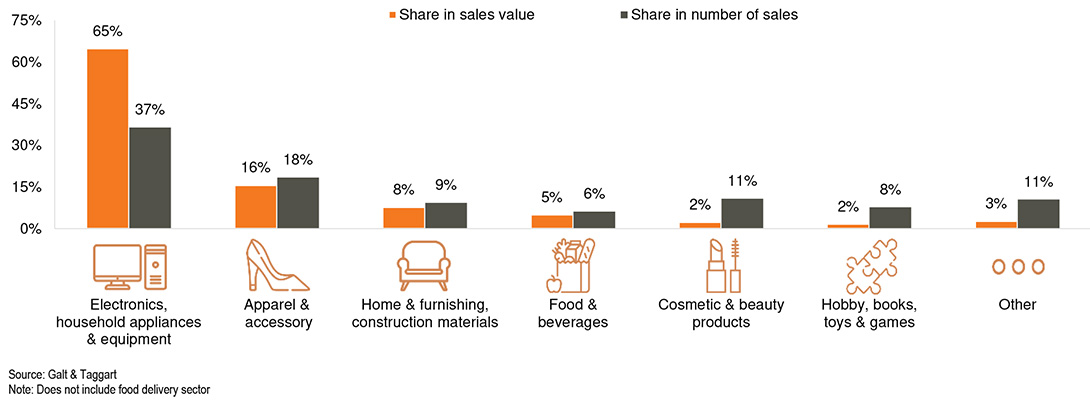

A further supportive factor of this prediction is the fact that there is low penetration in all product categories, from approximately 0.5% in groceries and non-specialised stores to about 3% in electronics / appliances, G&T says, leaving ample room to scale across all categories.

Meanwhile, the most popular categories amongst Georgian online shoppers are electronics, household appliances and equipment, accounting for 65% of local e-commerce sales in 2020. Apparel and accessories came in second, grabbing 16%, followed by home and furnishing materials, with an 8% share.

Food delivery has earned a special niche in Georgia’s digital buying ecosystem, G&T notes, as Georgian retailers used food delivery channels to deliver grocery, personal care and pharmaceutical products during the pandemic. This is contrary to developed markets, where retailers have their own in-house delivery services. We estimate the food delivery sector turnover at 167 million GEL in 2020, up 3x from 2019, with grocery and personal care products accounting for 20% of the total. Whether retailers will stick with this third-party delivery scheme or invest in their own delivery channel depends on different factors, including the availability of financial and human resources.

As for the makeup of e-commerce payments, cash grabs a surprisingly large portion at 15-20% of total turnover, with many customers opting to pay upon delivery. Two reasons for this, G&T posits, could be a low trust in digital payments and low usage of mobile internet banking.

E-commerce down the road

Local Georgian e-commerce platforms have a long ways to catch up with international players, the growth of spending on which has grown at an annual rate of 40% between 2018-2020. The four largest players in Georgia – Amazon, eBay, Taobao, Aliexpress – take two-thirds of total purchases.

However, total online retail spending is expected to grow at 30% CAGR to 2.2 billion GEL over 2020-2025, with local e-commerce grabbing half of online retail spending by the end of that term (compared to a 23% share in 2020). This will follow on the back of the development of local retailers’ online platforms and increased trust from customers.

G&T expects local e-commerce spending to grow at a CAGR of 52% to GEL 1.1bn over 2020-25, yielding a penetration rate of 4.7%.

The fashion and beauty sector has the best chance of digital transformation in Georgia in the near future, G&T says, as fashion is one of the most developed e-commerce sectors globally.

The outlook for the electronics and appliances segment is also very positive, Groceries meanwhile have an entirely open playing field as the least penetrated category in the country.

However there is ample room to scale up across all product categories, the G&T report reads, as e-commerce penetration is less than 3% in every product segment in Georgia.

Improvement of user experience is crucial for sector development. Poor customer experience of local online shops remains a challenge – most online retailers lack the basic features for convenient shopping (including price lists, product availability, geographic coverage, etc.).

As a result, Georgians spend 3.3x more on international online shops than locally.

The improvement of the full shopping experience (from search to delivery) is crucial to attract and retain users, requiring large financial and human resources. Therefore, economies of scale are vital for e-commerce development, creating strong growth potential for leading third-party marketplaces. Mymarket.ge (primarily C2C model) is the largest online shopping platform in Georgia, attracting more than a million unique visitors monthly (2021). Extra.ge is the largest B2C marketplace (c. 500k monthly unique visitors), followed by vendoo.ge (230k unique visitors) and be.ge (>130k).

On top of this, there is an urgent need to improve digital infrastructure, increase usage of internet/mobile banking services and develop the logistics environment. In this regard, Georgia should capitalize on its developed banking sector, widespread internet accessibility and the country’s relatively youthful population.