G&T: Georgian wine industry entering a new era

As Georgia enters the peak of another fruitful grape harvest, the wine industry is implementing new measures aimed at improving both the quantity and quality of its products. G&T takes a look at recent developments in the Georgian wine business and examines how the sector might just double its profits in five years.

The Georgian wine industry is at long last entering a new era, G&T writes in its recent report on the country’s wine and spirit sector.

Global trends in wine consumption are guiding the Georgian market to evolve in ways industry experts have long been calling for: away from quantity and towards quality. This is because wine consumers are drinking less but better, Wine Intelligence data for 2007-2019 shows, and they are searching for low-alcohol and ‘organic alternatives.’ Consumers are willing to spend more per bottle as well, and attention to labelling and design have become particularly important factors in affluent markets such as the UK, US, Canada, Australia and Japan.

Global trends in wine consumption are guiding the Georgian market to evolve in ways industry experts have long been calling for: away from quantity and towards quality. This is because wine consumers are drinking less but better, Wine Intelligence data for 2007-2019 shows, and they are searching for low-alcohol and ‘organic alternatives.’ Consumers are willing to spend more per bottle as well, and attention to labelling and design have become particularly important factors in affluent markets such as the UK, US, Canada, Australia and Japan.

‘Not missing a drop’, G&T’s report notes; the Georgian wine industry is keeping up with these trends.

To do so, Georgian companies are increasing their capital investments into product quality and improving product mix, experimenting with unique Georgian grape varieties and mixing Georgian with French and other international varieties to discover unique flavors.

Further quality stabilization will be supported by a trend of increased investments in vineyards by large wine companies, allowing for more uniform production and quality assurance, a problem that has otherwise plagued the industry for years. Kakhetian Traditional Winemaking, by far the largest private sector winemaking company by market share, is itself planning to invest nearly $52 million into its own vineyards, adding c. 3,458 hectares of vineyards to its base by 2024.

On the back of these developments, grape yield per hectare is also expected to grow, for which there is plenty of room: G&T estimates overall current yield at 5.3 tonnes per hectares, which is nearly two times lower than the 2019 world average. G&T attributes the low yield to the fact that the majority of vineyards are owned by households which employ technologically unsophisticated production methods, though it notes that Georgia’s larger wineries enjoy a yield similar to global levels.

While market forces have certainly been a factor in convincing farmers to alter their production models towards quality over quantity, the National Wine Agency has also done its part: mandatory quality controls on wine destined for exports and tightened export procedures have also done much to raise the overall perception of Georgian wine abroad.

Indeed, some industry shake up is expected this rtveli [harvest season] after the NWA released new regulations stipulating grape sugar content be no lower than 18% to be eligible for use in winemaking; otherwise, grapes will be classified as suitable for the production of spirits only.

G&T Senior Analyst Tatia Mamrikishvili says that while the new regulations may cause some discomfort amongst a portion of producers, the brokerage believes the move is ‘a step in the right direction, moving the price of quality grapes upwards, and incentivizing farmers to shift towards the quality over quantity paradigm.’

Numerous awards and impressive victories at international wine competitions in recent years have also helped cement Georgian wine as a brand of quality: Georgian wines took 13 gold and 1 silver medal at the 8th Sakura international competition held in Japan in 2021, while they were awarded with gold and silver medals at the International Rosé Championship held in Poland in 2020.

Wine marketing efforts have borne fruit in new target export markets as well. Since 2013, the NWA has been investing heavily to popularize Georgian wine in new strategic markets, including the US, UK, China, Poland, Japan, Germany and others. Georgian wine companies participated in more than 20 international exhibitions and 242 wine tasting events in 2019-2020.

Exports

While domestic consumption more than halved during the pandemic due to the fall off in tourism, exports came to the rescue and buoyed the sector significantly to prevent serious damage.

“Wine in general is a commodity more resilient to wider price shifts”, G&T’s Mamrikishvili notes, citing figures that global wine exports were down just 1.7% in volume and 6.7% in YoY value in 2020.

“Local wine and spirit exports were down just 1.5% in 2020, which is a low contraction for the year. Demand from target markets such as the US, UK and the Baltic states was up, while traditional markets stayed comparably stable,” Mamrikishvili adds. Wine exporters are entering new markets, the report notes, but dependency on Russia and other post-Soviet countries remains significant. Exposure to new export markets (the US, UK, China, Japan, Germany, Poland and the Baltic states) has increased in recent years, accounting for 21.5% of total exports in 1H21 in value terms, up from 10.9% in 2013. However, Russia still absorbed around 58% of Georgia’s total wine exports in 2017-2020. This is a result of developed trading networks and benefits from the widespread popularity of Georgian wine in Russia, which removes additional marketing costs.

Considering the painful effects of the Russian 2006 embargo and the unpredictability of this market, G&T writes that diversification to other markets should remain a number one priority for Georgian wine companies in the medium to long term.

Overall, the brokerage’s expectations on exports are positive, supported by growing investments in vineyards, government support for the sector, healthy demand from export markets and free trade agreements with the EU and China. This is good news, considering exports remain the main driver for sector revenue growth, with 82.4% of total turnover coming on average from export markets between 2012-2020.

G&T also anticipates the average export price to increase, along with a gradual transition towards new export markets in the medium term. Considering this, G&T says wine exports are expected to almost double in the next five years to around US $350 million by 2025.

Notably, the average export price for Georgian wine is 26% higher in new target export markets (the US, UK, China, Japan, Germany etc.) than in Russia and other CIS states. Since 2013, in cooperation with the private sector, the NWA has been investing heavily to popularize Georgian wine in new strategic markets, including the US, UK, China, Poland, Japan, Germany and others. As a result, Georgian wine exports were up at a CAGR of 22% to $13.3 million to China, 19.5% to $11.3 million to Poland, 28.9% to $4.2 million to the USA, 20.9% to $2.6 million to Germany, and 26.7% to $1.3 million to the UK, from 2013-2020.

The sector has shown resilience to the COVID-19 crisis, with turnover down by just 2.1% YoY to GEL 1.1 billion in 2020 thanks to strong external demand, making up for the domestic market more than halving in 2020. G&T expects a full recovery in line with the restoration of tourism sometime in 2022.

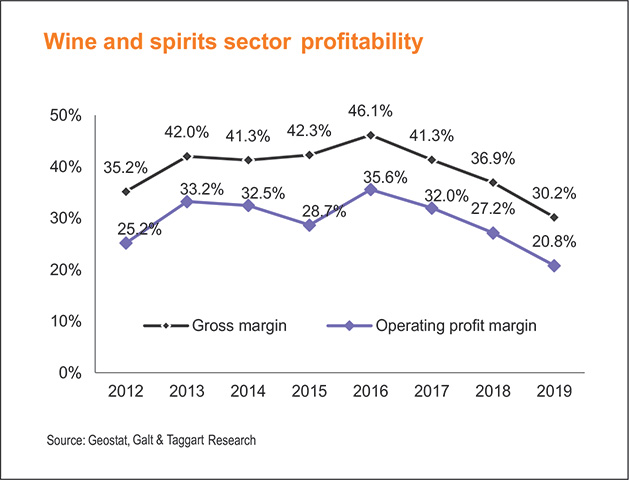

Despite the drop in tourism, the wine and spirits business continues to be one of the most profitable sectors in Georgia, posting 30.2% gross profit and 20.8% operating profit margins in 2020, 1.4 and 1.7 times above the business sector averages, respectively.

Notably, the top 10 companies have outperformed sector performance, with weighted gross profit and EBITDA margins averaging 41.2% and 24.9%, respectively, over 2017-2020. The sector remains fragmented, but the share of large companies is increasing. Out of 625 companies operating in the sector, only seven are large, 37 medium and 581 small, with small and medium companies generating c. 59% of total revenue in 2020. However, the share of large companies increased to c. 41% of total turnover in 2020, up from 12% in 2015. G&T sees further consolidation potential which will improve the sector’s financial performance.

Next drops

Wine companies should be more ambitious to grab a greater market share in new target export markets, G&T writes in its report.

Despite some success, Georgia still accounts for less than 1% of total wine imports in new target markets (excluding Poland, where Georgia holds 3%). One of the main obstacles behind low exports are high costs associated with marketing and product shelving as well as companies’ fear of investment failure.

Notably, a new state co-financing program seeks to address these concerns with support for expenses associated with marketing in new target markets.

Mamrikishvili says this is indeed the way to help the country’s wine industry along: “Subsidizing the sector through the direct or indirect purchase of grapes from farmers has served as a disincentive to improve quality and product. The new scheme will be more beneficial in the long-term development of the industry and will help popularize Georgian wine on new markets.”