TBC Capital’s monthly tourism watch: sector continues to grow but remains vulnerable

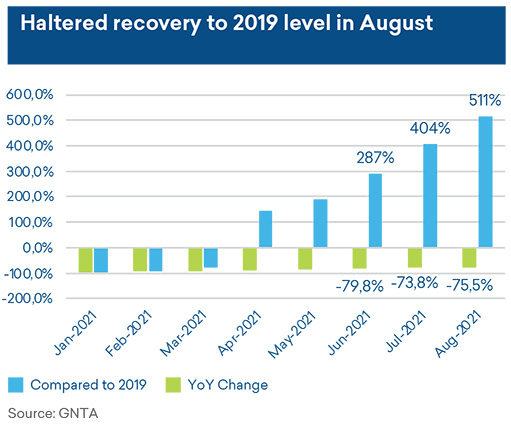

As the second summer of the pandemic draws to a close, TBC Capital’s recent tourism monthly watch report shows the sector has seen a strong rebound compared to 2020, with visitor growth up more than 500% in August. Despite these promising signs of recovery, numbers remain far below 2019 levels, indicating that the sector still has a long way to go.

Strong MoM growth in June and July indicated that the sector may see less seasonality in 2021 as delayed demand flattened what is usually a peak of tourism in August and sharp decline from September. However, due to the fourth wave of COVID-19 in August, revenue and visitor numbers slumped, underscoring the sector’s continued vulnerability to the epidemiological situation in the country.

Recovery Forecasts

While the industry has seen exceptional YoY growth from 2020, it is still lagging considerably behind pre-pandemic levels. Georgian Minister of Economy Natia Turnava estimated back in May that tourism revenue would recover by up to 50% of 2019 levels by the end of 2021. Recently, however, she revised that statement down and indicated that recovery of around 25 to 30% is expected this year.

TBC’s Head of Research Irina Kvakhadze stresses how vital the country’s epidemiological situation will be to the sector’s recovery: “While June and July saw impressive growth, the August data is slightly disappointing and large-ly a result of the fourth wave of COVID-19.” TBC’s forecasts estimate that tourism revenue could recover 37.5% of 2019 levels by the end of 2021. Moreover, she notes that “forecasts for 2022 recovery are as high as 80% of 2019 levels – but again, this is largely dependent on the COV-ID-19 situation and the vaccination rate.”

Origin and Number of Visitors

Georgia’s visitor numbers grew YoY by 511% in August, reflecting substantial growth since the summer of 2020. However, visitor numbers still registered 75.5% lower than 2019 levels.

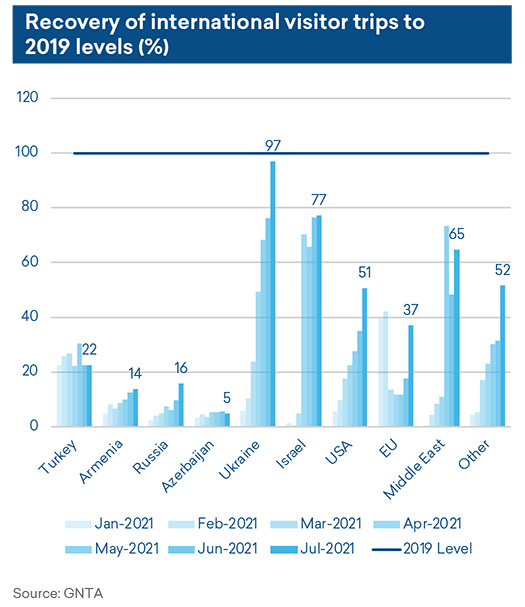

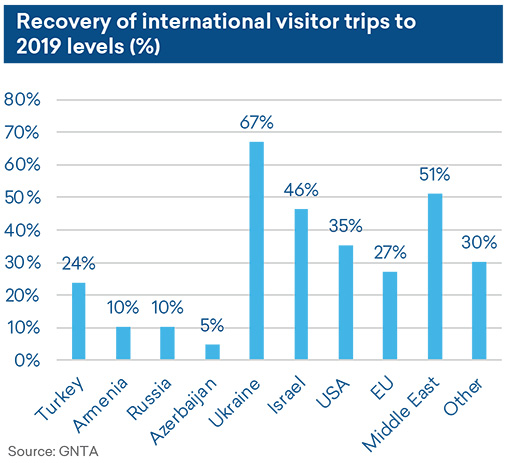

In July, the share of travelers to Georgia who came from neighboring countries was 38%, down from 72% in 2019. This substantial decrease in visits from neighboring coun-tries can be attributed in part to Georgia’s closed land borders, which reopened for the first time since the pandemic began in June. In August, this figure grew to 41%, and the share of tourists coming from neighboring Russia and Turkey increased. The largest share of visitors in August originated from Russia, Turkey, Ukraine and Armenia.

Notably, in the first seven months of 2021, a strong recovery was seen in the number of travelers coming from Ukraine, Israel, the Middle East, the US, and the UK. COVID-19 safety in origin and destination countries has a strong impact on travel decisions, so it is unsurprising that travel originating from countries with higher vaccination rates has seen higher recovery.

Tourism Revenue

In July, tourism revenue amounted to 52% of 2019 levels. While August was expected to register even higher growth, revenue decreased to 48%. Tourism revenue has notably recovered at a faster rate than the number of trave-lers. This indicates that the spending habits of tourists are changing. In July, the average spending per visitor was 98% higher than in the same month of 2019.

As TBC Capital’s head of research, Irina Kvakhadze notes, “this could be due to delayed demand. Because of the risks and costs associated with international travel currently, many tourists are taking extended trips, which is increasing their spending.” Other factors, like accidental savers, people eager to change locations after lockdown, and the rise of ‘work from home’ positions could all be impacting the length of time visitors are staying.

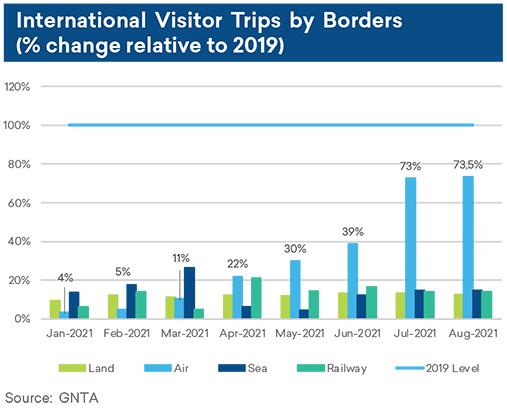

Air Travel

In the summer of 2021, air travel replaced land crossings as the number one method of arrival to Georgia. In July of 2019, land border crossings accounted for 76% of arrivals. In July of 2021, air travel surged in popularity, accounting for 60% of all arrivals. This is most likely due to additional restrictions and closures of Georgian land borders that only opened on June 1.

Despite the opening of the borders in June, land arrivals saw slow recovery in July, amounting to only 13% of 2019 levels. Air travel, on the other hand, recuperated to 73% of 2019 levels in July and 73.5% in August.

The Hotel Industry

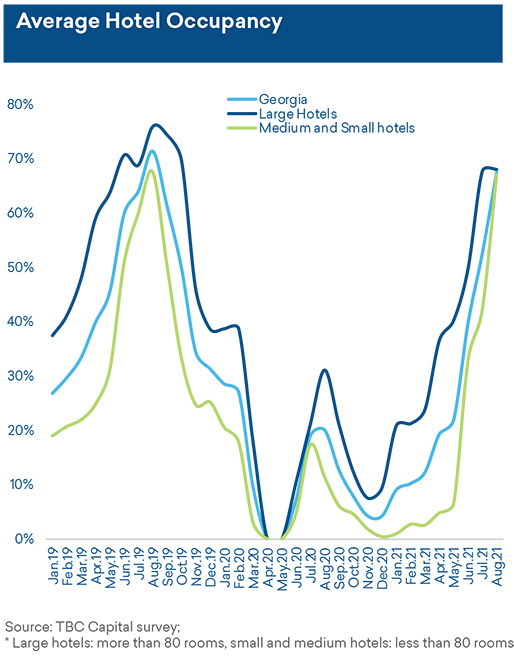

The hotel industry has seen impressive growth this summer, which could be a result of increased safety meas-ures and higher levels of domestic travel. Hotel occupancy rates averaged 40% in June, 53% in July, and 67% in August.

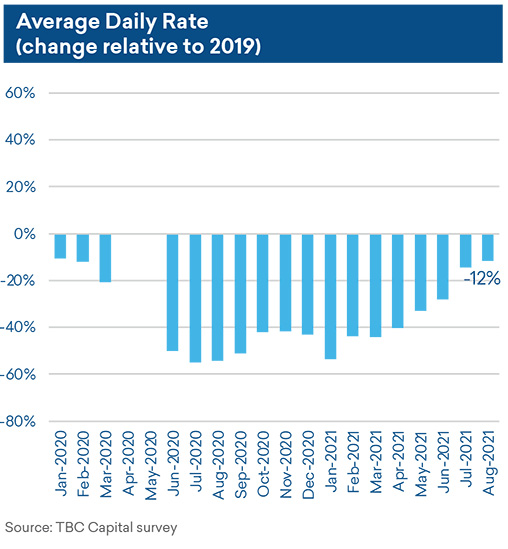

Average daily rates (ADR) have also seen a steady recovery since March of this year. According to a survey done by TBC Capital, ADRs in July were only 14% behind 2019 levels. In August, ADRs were only 12% below pre-pandemic prices.

See more at www.tbccapital.ge and subscribe to our news-letter for more information: https://tbccapital.ge/?subscribe