Investors get new opportunities – and 5% plus

Proponents of Georgia’s capital markets are delighting at the news that two novel funds are entering the market. But what’s on offer? And who’s backing them? Investor.ge takes a look.

Suddenly there is choice in Georgia’s savings market. June brought two innovative new funds and a new industry player to the market. While hardly a revolution, this does double the Georgian funds that are on offer, even though only to institutions, foreign investors, and rich individuals. So, the market currently remains polarized – the bulk of the population has just low-interest bank deposits in foreign currency, or higher local currency rates, which brings currency valuation risks. This leaves the Georgian capital market still lagging behind most of its peers. However, more funds are promised: one being “green” and one, perhaps, for ordinary investors.

These two new funds come from TBC Asset Management and one from a fresh name on Georgian capital markets, Foresight Investment Management, although it is run and supervised by a team of highly experienced Georgian ex-bankers, investors and entrepreneurs. Both managements state that they are responding to gaps in the market, offering diversity, and minimalizing risk – and both offer a return of 5%. Both funds have been in the pipeline for some time; work started following the National Bank of Georgia’s announcement of revisions to the Law on Investment Funds, which was passed the summer before last.

TBC Asset Management

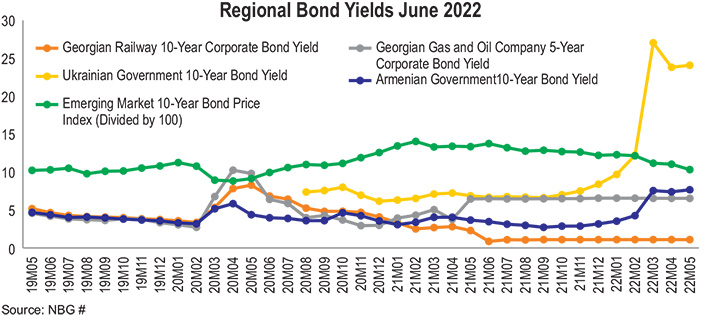

The reason for the TBC Group’s fund, says TBC Asset Management director Tamar Kuridze, is that the “current local market does not have much diversity in the offerings, the choices are limited to deposits, real estate, and bonds.” In the current climate, deposit rates are falling and bonds look too risky.

TBC Asset Management has already raised $5 million for what is planned to be a $30 million fund, with most investors so far being foreign individuals. The fund is investing in diversified Georgian credits with a portfolio of loans issued to Georgian blue chip companies.

Giving further details, Tamar Kuridze explains: “We will invest the proceeds mostly in a diversified credit portfolio and some part in liquid assets. Loans that we invest in should be issued in EUR or USD, be secured by collateral, and issued by the Georgian credit institutions. The loans are issued to Georgian Blue Chip companies. The fund offers a better risk/reward profile to investors interested in the Georgian market, as the risk is lower than bonds and the benefit is higher than the one Georgian deposits offer.”

Tranches in the fund will be offered every 1-2 months, driving its growth, and investors will be able to redeem part of their shares twice a year. The return target is 4.5% plus six months LIBOR (an interest rate benchmark used in international financial markets). The LIBOR is currently 2.6% (meaning there would have been a yield of 7.1% based on the rates prevailing in early July) and is expected to rise, thus so will the targeted return for the fund, as all the loans in the fund’s portfolio will have floating interest rates. The fund will pay out twice yearly all the profit it earns, for the periods ending in June and December. The dividends will be denominated in USD.

Tamar Kuridze says TBC Asset Management has a number of new funds in the pipeline, one of these to be a retail fund (aimed at individual investors), where it also sees a gap in the market. TBC Asset Management is a new subsidiary of TBC Bank, but despite its small size, it has sufficient in-house experience to manage a range of funds. The team’s experience encompasses international financial services, strategy and corporate management, as well as investment. Its supervisory board also has broad experience in investment banking, private equity, and capital markets.

Foresight Capital

Foresight Capital, the other new fund, is also a response to what its founder, ex-banker and entrepreneur Gia Morchiladze, saw as unattractive bank rates. As he told BM.ge “I went to one of the banks to extend my deposit and when I was offered a rate of less than 1% in foreign currency. I was indignant, and then I realized how many opportunities there are in the market!”

With 20 years of banking experience behind him topped by 15 years building a commercial property asset portfolio and a diversified range of businesses (from agriculture to mining), he lost no time in registering an investment management company to take advantage of the opportunities he saw. He then embarked on months of negotiations on his fund to show his team had the suitable experience and competence. He describes his unusual (for Georgia) fund objectives, emphasising its solid asset backing, secured by commercial real estate. Returns are expected to be “at least 5% per annum,” he says. Although aimed at qualified investors, it can try out the retail market as technically 20 ‘uninformed’ investors are allowed.

“The fund will invest in fixed-income debt instruments as well as, in certain cases, participate in equity ownership of income-producing assets. The fund will invest in instruments issued in and assets located in Georgia.”

According to Morchiladze, “It will invest in the following types of financial instruments:

- Commercial bank current accounts and deposits (USD, GEL)

- Commercial bank deposit certificates (USD, GEL)

- Private and public secured debt instruments issued by local companies

- Direct secured loans to local business entities

- Equity investments in local business entities that own real estate; only with fixed equity repurchase agreement.”

“All of the fund’s investments must be secured by real estate,” he adds.

Sectors in which the fund will invest right up with the current international investment preferences are: energy (only renewable); agriculture (only export-oriented); healthcare (with medical tourism potential); development/construction; commercial real estate (only with existing lease agreements).

“The fund investors will receive dividends monthly or quarterly from the fund’s income generated from portfolio investments (interest income and dividend income). In case an investor wants to exit the fund before the fund closes, we help them find a buyer for their units in the secondary market,” he said.

He recently explained to BM.ge what he sees as Foresight Capital’s competitive advantage. “First of all, our main task is to protect investors, which we achieve by securing our investment in real estate – this is one of the most important aspects of our offering,” he said.

Second is his optimism about the returns that Foresight Capital will be offering. It is based on the fact that the group team’s wide expertise already includes successful investment in commercial real estate, which offers a better return than residential property or bank deposits – and in various industry sectors.

“And what I want to mention about the team that is the founder or managing team of this company, is their professionalism, experience and dedication to the work and knowledge that they have acquired in international and local markets,” said Morchiladze. He could also have added their long individual track records. This explains why the NBG welcomed this new group into its capital markets, which have long been deprecated by the international financial institutions as underdeveloped. Plus, he has reassured that he has no plans to compete with the banks.

Other co-founders of the Foresight Asset Management company are Archil Melikadze and Giorgi Gogotchuri. Archil is a finance professional educated in the U.S. with top-level international experience, working for many years in major international and local private and public organizations. Giorgi Gogotchuri has extensive experience managing successful businesses and has “a distinctive talent for discovering remarkable business opportunities.” The Supervisory Board, apart from Melikadze and Gogotchuri, comprises Vano Vakhtangishvili and Levan Diasamidze, the former having been in banking for decades (he was also Vice President of the National Bank of Georgia in the 2000s). Diasamidze is also a senior ex-banker.

Finally, according to Gia Morchiladze, “the third advantage is portfolio diversification.”

Backing from the NBG

Outlining the regulatory backing, the NGB says that: “The updated regulatory framework is based on the EU directives (UCITS and AIFMD) as well as experience of international best practices in this field. We have also taken into account the level of financial market development in Georgia and therefore we created a framework for two types of retail investment funds (classical UCITS and Retail Investment Fund). Both categories are subject to the NBG Regulations. However, Retail Investment Funds are subject to less investment and eligible asset restrictions than UCITS but are subject to a regime more restrictive than the Alternative Investment Fund (Registered Investment Funds) Regime.”

It further added that “we do not foresee any more regulation to come nor do we believe that existing legislation is complex and onerous.”

The reason that there are, as of yet, no retail funds for “the man in the street”, says the NBG, is that: “Development of retail funds at the moment is mainly a result of lack of experienced fund managers in Georgia, who are first-time managers and are more suited for operating non-retail (registered) funds before they accumulate enough track record to manage retail funds.”

However, here are two fund management groups that seem to have the experienced teams needed and which have already started to establish a track record. So, there is hope yet for an alternative to deposits or crypto for the ordinary investor.