G&T: Georgian electricity market posts first trade surplus in a decade as global energy prices rise

The global energy crisis has caused pain at the pump for consumers worldwide and left many in Europe wondering how they will be able to keep the lights on this winter. And while Georgians have certainly felt the pinch of rising petrol prices, electricity consumers have felt less cause for concern amid minimal price increases. So, how has Georgia’s electricity m arket fared amid the current crisis? G&T’s latest Electricity Market Watch breaks down the most notable trends from the first half of 2022.

Electricity supply, demand, and local consumption

Electricity supply, demand, and local consumption

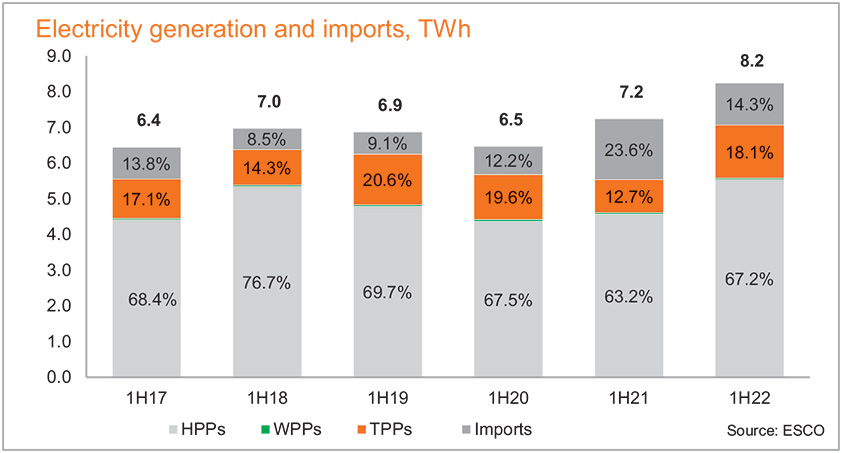

The Georgian grid received 8.2 TWh of power in 1H22, of which 7.3 TWh was consumed domestically. Of the 8.2TWh supplied, 14% was imported, while 67% was produced through hydro generation, 18% through thermal production, and .5% through wind generation.

Domestic consumption grew substantially by 9.8% y/y (6.6% in Abkhazia and 10.7% for the rest of Georgia), which G&T’s Senior Research Associate Mariam Chakhvashvili says was largely due to increased industrial production. “Some industries, like metallurgy, are heavily dependent on global prices, and their production slowed in 2021,” she notes. “However, export prices have increased, and as a result, so has production, making it one of the main drivers of higher consumption in the first half of 2022.”

The rise in consumption, according to G&T analysts, was largely compensated for by higher levels of hydro generation, which increased 21.1% y/y. This significant growth was, in part, due to more favorable hydrological conditions and a low baseline of production from 1H21 when the Enguri Dam was closed for maintenance work.

International trade

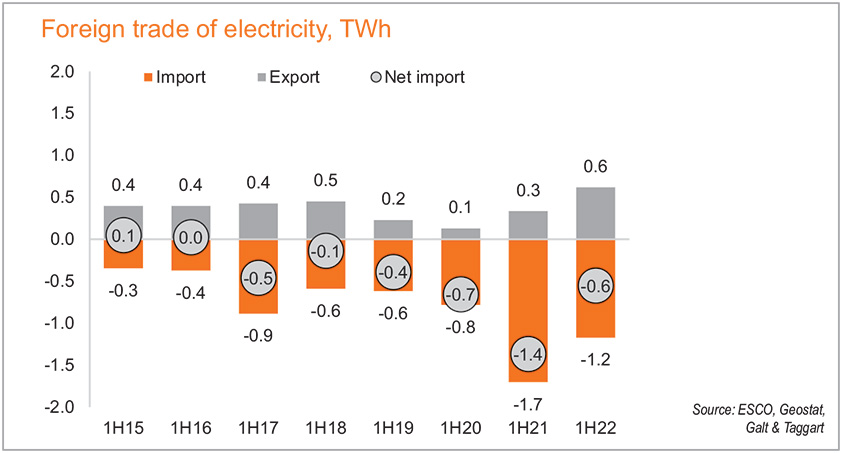

A glance at trade statistics from 1H22 would seemingly indicate that Georgia’s electricity market had a banner first half of 2022. And in some respects, it did. With the market posting a positive trade balance in USD terms ($21.1 million) for the first time in more than a decade and electricity coming in at number six in the list of top exports, it is evident that the market benefited from rising electricity prices in its export markets.

Electricity prices in Turkey almost tripled from USc 4.2/kWh in 1H21 to USc 11.6/kWh in 1H22 as the country’s dependence on thermal production left it vulnerable to surging global natural gas prices.

At the same time, Georgia’s source markets for imports were marginally impacted by the energy crisis due to their roles as price setters in the global market. While electricity import prices from Russia and Azerbaijan did increase in 1H22, the change was minimal for Georgia’s domestic market. In the case of energy imported from Azerbaijan, for instance, the average import price increased from USc 4.6/kWh in 1H21 to USc 7.5/kWh in 1H22, while the average export price stood at USc 14.5/kWh. This left the Georgian market in a prime position to supply its surplus of electricity to Turkey at high margins.

But a deeper look into the numbers offers less cause for optimism. For one, analysts at G&T see this boost in exports as temporary. “We cannot depend on electricity prices in Turkey to stay this high, meaning that the current trade surplus is probably a short-term phenomenon,” says G&T’s Chakhvashvili. “We see the situation as a temporary gain brought about by the current global energy crisis.”

Further to that, this positive trade balance does not indicate any decrease in Georgia’s energy dependency. Instead, it is more related to the price of importing electricity versus natural gas. In 1H22, the average price to import electricity stood at USc 7.5/kWh, while the price of thermal generation ranged between USc 3.3/kWh and USc 4.5/kWh. As a result, Georgia ramped up thermal power production, which relies on natural gas, by 62.4% y/y and decreased its electricity imports by 31.1% y/y. This shift from electricity imports to natural gas imports shifted the trade balance sheets but is not indicative of an increase in Georgia’s electricity production capabilities, nor does it denote a decrease in energy dependency.

“It doesn’t really matter if you are importing electricity or creating it thermally – both methods are reliant on energy imports,” says Chakhvashvili. “Data shows that Georgia remained a net importer in kWh terms in the first half of the year, and Georgia’s dependence on energy imports has continued to increase in recent years. Given the current global crisis and the security implications involved, it is certainly a concern that should be addressed.”

Market reforms

One key element of increasing energy independence is a competitive domestic market, which is a goal the Georgian government has been working towards with its upcoming introduction of a day ahead market and reforms to its balancing market. These new markets, which were most recently slated to open on September 1 but have been postponed due to regulatory issues, are now set to launch on March 31, 2023.

G&T’s Chakhvashvili says she is optimistic that the markets will not be delayed past March and that they will be an important part of creating confidence for investors in Georgia’s electricity market. “These reforms aim to increase the transparency of pricing and move it from a model based on regulation to one that is more in line with supply and demand. If the market defines the price, then the hope is that down the line, investors will be able to look at the market’s record and say, ‘we understand what drives the market and we are confident enough to invest without government support and subsidies.’ This is how the European markets work, and it is an important part of creating a competitive electricity market for Georgia in the long term.”