DIY-ers dominate Georgia’s home renovation market

The Georgian DIY (do-it-yourself) sector is red-hot, with demand for accommodation of all sorts soaring. Increased rent prices, migrant inflow, and tourism recovery following the pandemic means many have a lot of extra cash. Strong sales of renovation and improvement materials and products are helping this profitable retail trade expand rapidly.

Georgia now has a booming $2 billion-plus DIY industry – part of the $3.4 billion-plus construction market, which was showing growth of 29% in its renovation sector overall last year, according to an industry report from investment bankers Galt & Taggart. (Though, as worldwide, the proportion of the customers doing the work themselves, rather than employing workers, continues to be partially retailer guesstimates).

Worldwide, refurbishment is a “lucrative business,” according to research from U.S.-based international research group Global Market Insights, but does not match Georgia’s rate of growth. U.S. research group Research Dive puts the annual rate of global growth rate at over 6% and forecasts the DIY sector alone to reach $1.3 trillion in a few years’ time. In the Asia-Pacific region, for example, it forecasts a 3.9% annual growth rate and in the Americas, one of 4.5% between 2021-2027. Another U.S. market research group, ANGI, states that in 2022, U.S. homeowners spent an average of $10,341 on home improvements.

DIY boomed in the pandemic everywhere, driven by household economies and boredom. According to U.S. research consultants the Freedonia Groups, amid the pandemic, 39% of consumers were reporting that rather than just sit on the couch watching Netflix, they were working on home improvement and renovation projects. While in the U.S., households may have been adding swimming pools, in Georgia, in response to rising numbers of immigrants and tourists, the major focuses have been the addition of rooms for letting or putting homes on airbnb, as well as the construction of guesthouses.

Post-pandemic DIY boom

In the aftermath of the pandemic, it has been the global shortage of workers and the rising cost of materials that have been driving forces behind record high DIY revenues. The price tag on a DIY project can mean savings of anywhere from 50% to 80% on a comparable contractor’s job, according to the U.S. HomeAdviser website.

In Georgia, Galt & Taggart says, soaring material and product prices “reflect high dependence on imports,” reaching all-time highs in 2022. By last September, prices were stabilizing, though metal, while down 10% from peak levels, was still up 63% compared to January 2020, wood products were 67% higher, and plastic 44%. As a rough guide to prices for builders, analysts at investment bank TBC Capital put the rise in overall construction costs early this year at 21% compared to a year earlier.

Yet, unlike in the U.S. and Europe, where investment in DIY store groups can be made via stock markets, this highly profitable industry is inaccessible in Georgia as it is held in private ownership. Galt & Taggart forecasts put sector growth at 5% to 10% per year over the next five years.

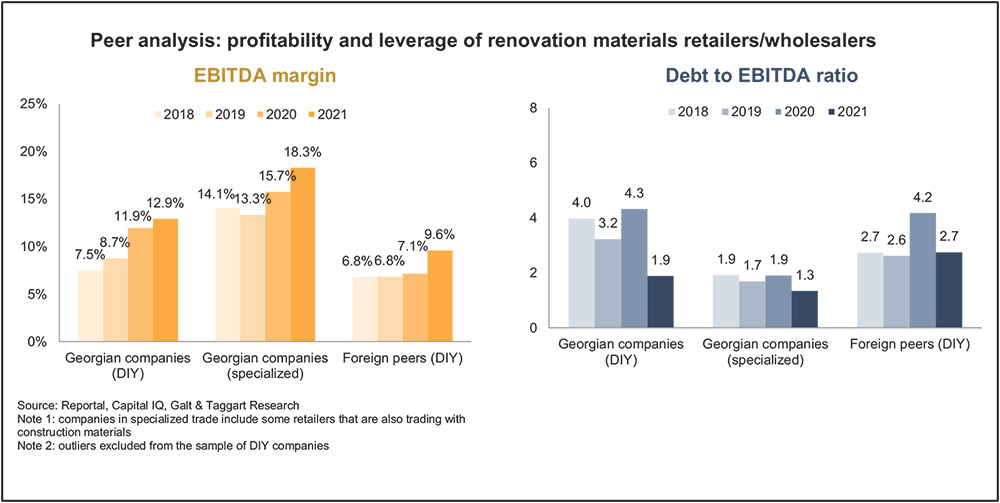

In terms of profitability, Georgian margins for companies in the home improvement sector have been considerably better than those of international peers. The latest year for which annual financial results have been published is 2021, and looking at the period of 2018 to 2021, Galt & Taggart states that margins overall in the renovation industry gained from 7.5% to 12.9%, while for the specialized DIY companies (those selling hardware, paint, glass, and wallpaper), it went from 14.1% to 18.3%. By contrast, the margins of Asian and European DIY stores rose from 6.8% to 9.6% over the period. The strength of Georgian companies is shown by the fact their cash flow was sufficiently strong for them to cut their debt levels considerably.

Georgia’s DIY retailers

Key among the major DIY retailers in Georgia are Gorgia, Domino, Modus, Bricorama, and Milhouse. The specialist retailers and wholesalers operating within the sector named by Galt & Taggart are Jaoken, Demas, Zodi, Kapelis, Sakhli, Citadeli and Nova.

With the market so attractive, it is not surprising that a number of Georgian construction material and specialist suppliers have “started to expand operations, shifting to DIY retail formats,” states Galt & Taggart, naming Nova as one example.

Money continues to be available to spend in the sector, as 2023 consumer spending is expected by TBC Capital to show 15% annual growth. Migrant’s expenditure is also expected to increase, with the estimated 115,000 migrant population forecasted to spend $1.7 billion this year against last year’s $1.1 billion. Forecasts from the German economic group, GET, put the immigrant share of GDP in 2023 at 3.2%, up from 2% last year, reflecting their average monthly income of $2,300 (according to a CRRC survey.)

Confidence in spending on refurbishing residential properties is coming not just from the recent state of the market, but also its prospects – after a 16% rise in sale prices last year, TBC is forecasting one of 21% for 2023, and for rental prices one of 53%. (After years of averaging just over $6 per square meter, last year the price shot up to $13.2, fueled by immigrant demand). In fact, at the highest level ever, and top in the region, Georgian rental yields – 12.1% in March – offer a better return than most other savings media internationally.

The major DIY marketing conundrum of whether to appeal to male or female shoppers that so preoccupies retailers in Europe and the U.S. does not (as yet) seem to be a concern in Georgia. The approach, among the larger outlets at least, seems to be to stock just about everything that relates to a house/guest house and its fabric – from builders’ tools to paint, polish, seeds, plants, furniture, barbeques, light bulbs, sanitary ware, tiles, to kitchen equipment. For the retailers, the till is the guide, although anecdotal information from Georgian shop assistants suggests that female shoppers are increasingly evident.

In the U.S. and Europe, surveys and analysis shows that “93% of women have completed a DIY project,” and, according to U.S. consultants Empathy Research, “49% of women said they really enjoyed doing DIY projects but 57% felt that sales people don’t think they’re knowledgeable on DIY due to their gender.” A significantly larger proportion of women (53%) than men (44%) believe, Empathy Research found, that DIY projects were a good way to spend their time.

External trade

The DIY boom is doing more than helping retailers expand. While imports have been rising at an annual rate of 4.5% (the first nine months of 2022 recording a $1.6 billion figure), local production of renovation materials has also been rising. The figures were up 18% at $291 million in total in 2021, though, according to Galt & Taggart, accounting “for only 18.9% of total demand.” Its analysts add: “The largest production is observed in plastic goods, such as tubes and pipes, doors and windows. Production of goods from wood also increased in 2021 – overall shares of local products was 27% for furniture and lighting and 5% for household appliances. Lowest dependency on imports is observed in the wires and cables category – local products accounted for 53.6% of total demand.”

The sector is even finding business overseas. Export of materials and home improvement products reached $168 million in the first nine months of 2022, says Galt & Taggart, and the recent rate of growth has been 4.9%. The greatest volumes have been going to Armenia ($65 million), Turkey ($21 million) and Azerbaijan ($20 million), but the export destinations include France ($6 million), Italy ($3 million) and the U.S. ($3 million) and these apparently reflect mainly furniture sales.

Little is forecast to slow down the growth in this sector, not even the current high interest environment and high level of material prices. The risks remaining are just two, suggests Galt & Taggart prudently – a sudden reversal in migration trends and geopolitical conflicts. Of the former, at least, there currently seems no sign.