Taking stock of Georgia’s capital market reforms

Georgia’s financial industry will have grown beyond recognition in a few years’ time. That is, if planned reforms come to fruition. The insurance sector will have doubled in size, the pension fund industry increase will be two-fold, foreign investor participation in Georgian markets could have more than doubled, as could the size of the non-banking sector. Local investors will be spoilt for choice.

For Georgians, an introduction to this new financial world will come with lures to encourage them to become financially active: tax incentives, user-friendly insurance products, and the ability to buy small units of securities. Companies are being given grants to help them raise money on the Georgian Stock Exchange. Revitalizing the exchange, now barely alive, is a major focus of the reforms and designs to remodel Georgia’s bank-centric financial system.

All this is set out in the latest, very detailed, report from ISET on capital market development reform. While it also lists many challenges, the pace of change is quickening as new regulations widen the Georgian financial scene. Locally listed bond issues are becoming more frequent, and Georgia is concentrating them in the internationally fashionable “sustainable” sector. Shares are thought to be some way ahead as they are more complex to administer, and Georgia lacks the experience and expertise.

However, currently, the most vital components of all – investors and secondary market trading – are still in short supply. Although the major banks’ investment arms TBC Capital and Bank of Georgia’s Galt & Taggart say they are seeing increasing private investor interest in their trading platforms from their banking clients, this is still largely tentative. And at this stage, what is on offer are mainly foreign, rather than local, investment opportunities. Fortunately, the current timespan of the reform program extends to 2028.

Those financial sector growth numbers are part of the government’s Capital Market Development Reform Program. Reform has been pushed for well over a decade now by the international development institutions – the Asian Development Bank (ADB), European Bank for Reconstruction and Development (EBRD), the International Finance Corporation (IFC), the International Monetary Fund (IMF), among others.

These reforms are also aimed at turning Tbilisi into a robust and active financial trading center and provide plentiful and easy-to-obtain, non-bank financing to stimulate the growth of even small companies. Plus, the strategy is aimed at fulfilling the vision of creating the right conditions for Tbilisi to host the premier regional financial hub. The targets set in the plan are for asset growth in insurance, banking, pensions and other sectors of finance, which dictates the amount of business they can do.

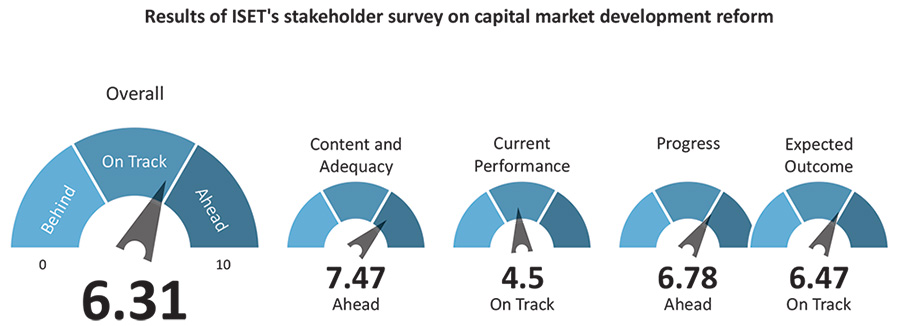

Of course, it remains to be seen if these targets will be achieved. The latest reform report from Tbilisi State University’s economic faculty and think-tank, ISET, and their USAID-supported project ReforMeter, says it is “on track.” Stakeholders have given an overall six out of ten score to what has been done so far, while describing progress as “moderate.”

If the strategy succeeds, according to this latest ReforMetor report, it could also usefully knock 0.8 percentage points off interest rates and boost GDP by 0.4% over 10 years.

New investment activity

2023 has seen promising signs of new investment activity all over the Tbilisi financial scene: refinancing of Georgia Capital debt (which highly unusually brought the rival two top banks to work effectively together to place it); new and very active investment platforms in foreign instruments for retail investors; rapid growth in the issuing of bonds that comply with international regulations on sustainable development; and the appearance of retail property-linked bonds.

One of this year’s successes has been the largest corporate bond issuances on the Georgian market: a $150 million, five-year bond issued by a diversified investment holding group, the London Stock Market-listed Georgia Capital, to refinance existing Eurobond debt. This sustainability-linked bond was bought by the international development institutions, including the EBRD, the ADB, and the IFC.

Other Georgian issuers choosing to list sustainability-linked bonds locally on the Georgian Stock Exchange have been Crystal Microfinance, with its Gender Bond Project to finance loans to women-owned MSMEs, and Tegeta, with its Green Vehicle Project, aimed at expanding EV use and expanding the EV charging network in Georgia.

Sustainability-linked bonds are a good choice as they are currently popular with major investment institutions internationally, with international credit rating agency S&P Global estimating that nearly $1 trillion will be issued in 2023. Welcoming the Georgian bonds’ local market listings in this sector, the ADB commented that this “will boost the confidence of international and domestic investors in the local stock exchange and gradually prioritize onshore over offshore issuance.”

However, the report from ISET makes no bones about the fact that considerable challenges remain, stating: “Presently, the market suffers from a deficiency in both the issuance of financial instruments and the participation of investors. The government securities market is the primary source of issuance, but its secondary market is relatively inactive.”

It continues, “Furthermore, the stock market is characterized by small size and limited liquidity. The domestic institutional investor base is limited and undiversified. Foreign investors are characterized by their limited involvement, while retail investors are characterized by their preference for foreign currency-denominated assets. The capital market’s small size and low liquidity are partially attributed to the prevailing dominance of commercial banks in the financial sector and elevated levels of dollarization.”

Georgia’s stock market

Georgian Stock Exchange figures for this year to early November for bond and stock trading show 24 trades in lari, valued at GEL 158,000 and no trades in dollars or euros. Gray market over-the-counter (OTC) lari trades numbered five and were valued at GEL 2.2million, and there were 19 Eurobond trades valued at EUR 1.6 million. Most OTC business is being done in dollar bond trades, which this year have numbered 80 and were valued at $10 million. Listed securities numbered 38, but eliminating duplication, there were 26 corporate issuers, including the ADB and IFC. Last year, out of 19 GEL transactions (the year’s total), 18 were in Liberty Bank bonds.

Yet, Georgia used to have an active stock market. In 2002, shares of 278 companies were trading on the Georgian Stock Market, with 42 active brokerage companies. By 2007, deal numbers had reached nearly 8,000, valued at $167 million. However, then in 2008, as pointed out by Professor David Aslanishvili, Doctor of Economy at the Webster University Georgia in a Tbilisi State University paper on Georgia’s capital markets, the authorities changed the rules. They effectively removed the need to buy or sell securities through a registered market or broker, and trade moved off exchange to “a gray, non-transparent ‘wild-liberal market’ market.”

So, the Georgian Stock Exchange lost its function, and, as he describes, “disappeared as a source of alternatives to bank loans.” The financial field was left in the control of the banks, and while they did not trade on it, they moved in to control the exchange. The published accounts show that TBC Capital, Georgia Capital, and Bank of Georgia’s investment firm Galt & Taggart own over 70% between them.

Evaluating the “organizational, corporate governance, and ownership structure of the stock exchange” is listed as one of the 2024 tasks on the government’s reform agenda. The ADB has said that the restoration of Georgia’s stock market as an “independent, strong and efficient body” is seen as a must.

Capital market reforms

The list for the Capital Market Development Reform’s ongoing and upcoming tasks is a long one and reflects work that the National Bank and the Ministry of the Economy and their advisers have done scouring the world for useful role models.

For companies, reform efforts will include educating corporate management on how market alternatives to bank finance work and how to set up and administer their own pension funds. This has been on-going for some time and is aimed at turning companies into potential players in the markets as both issuers and investors. The reforms also envision introducing derivatives and securitization, which will create interest-bearing, tradable, securities by repackaging pools of certain types of assets or debt to create investment instruments. A draft law to cover this is currently on its way through parliament.

For individual investors, the reforms will encourage brokers and financial advisers to set up business to boost retail investor engagement, create tax incentives to boost interest in tradable real estate funds, allow for life insurance products, and increase efforts to raise wider knowledge around investment.

Given the shortage of domestic stock market investments, the government has announced that it is considering offering shares in some of the 346 state companies to individual, private investors in some form. Among routes to market being explored are the “creation of a portfolio in the form of an investment fund, which will turn the shares of several enterprises into a single portfolio,” and shares could then be issued on the Georgian Stock Market. There were 22 state companies with turnover of over 20 million GEL in 2020.

Investment platforms

The shortage of local investments means that it is overseas stocks and bonds and other instruments that private client online investment platforms of the main Georgian investment banks and brokers are offering online. These are, reportedly, attracting a lot of tentative action, even if currently on a small scale.

Galt & Taggart, whose founders played a leading part in the revolutionary 1990s drive for a Georgian stock market, was also in very early to the international broking field here. For the last eight years, partnering with international trading facilitator Saxo Bank, it has been offering investors in Georgia worldwide access to markets and instruments via its trader.ge platform. Reaching out to a broader retail audience, it launched in 2021, with Bank of Georgia, a Georgian language investment service integrated into the Bank of Georgia’s mobile banking app. This is again international, with access to 6,500 instruments on U.S. markets, and with the advantage of allowing fractional trading based on value.

Right now, the interest in U.S. and UK treasury bills are high, due to historically high refinance rates. This in turn assisted local corporate bond markets and activity on primary placement. However, early signs suggest retail interest, those who favor high return and high risk approaches, has started to move on from U.S. and UK fixed interest investments as yield prospects diminish. It has found local interest at retail level in the recent Georgian bond issues, which “has been robust,” attracted by their yields, says Head of Brokerage at Galt & Taggart David Nishnianidze.

Also expanding its retail investment service, TBC Capital, together with its parent TBC Bank, launched in October an investment platform within its digital bank app. This gives its Georgian clients access to more than 6,000 U.S. stocks and exchange trading funds, dealing free of commission and account maintenance fees. “Users can invest fractionally – that means that we do not have any minimum investment requirements – and you can start investing starting from $1,” says Bakar Maruashvili, Vice President of Technology in TBC’s brokerage business.

Early participation is encouraging, so hopes are high for strong growth. TBC Capital’s idea for its mobile bank app is to create “One Place for All Your Investing – starting from deposits to stocks, ETFs, commodities, etc..”

An important factor in the relatively slow progress on capital market development in Georgia, Lasha Jugeli, the Executive Director of the Association of Georgian Financial Markets Treasuries, has told journalists, is “a pervasive lack of knowledge, indicating an imperative need for extensive informational and educational interventions.” The accumulation of investment opportunities and heightening publicity for all the new investment services, funds, and money raising can thus only help bring change.