The changing dynamics of Georgia’s capital markets

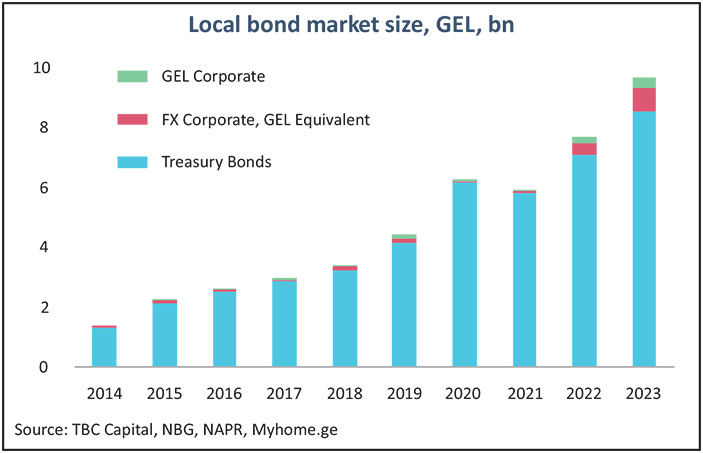

Georgia has been enjoying increasing recognition among international investors, along with other “frontier markets” – the financial market term for high-growth, but the most risky, newly emerging countries. This despite the fact, as UK-based international fund data and research provider Trustnet is noting, that its “reasonably robust economic drivers are offset by political and geopolitical risks.” However, Georgia’s bond market development has made considerable progress, being valued at around $800 million at the end of 2023, up from $205 million in 2018.

For international frontier funds and risk-averse high-net-worth individuals, the attractions have been Georgia’s wide range of investments. It is offering not only local government and corporate bonds, but several from international development banks, all with the offer of competitive yields. Access to Georgia’s fast-growing small companies is also being expanded with work by the USAID Financial Innovation Program.

Forecasts for Georgian capital markets have been positive, foreseeing a steady accumulation of scale. This should be led by further increases in the number of issuers as corporates restructure their finances, replacing their traditional bank loan funding with stock market quoted bonds. Both Georgia’s major investment banks, TBC Capital and Galt & Taggart, anticipated earlier this year that these increases will in time overcome the hurdle for international investors of lack of scale and liquidity.

Capital markets as a key to development

Why the concern about capital markets? Numerous studies, such as a recent one from the World Bank – Capital Market Developments, Causes and Effects – show highly positive impacts from their development for the population: “…a strong correlation has been found between capital markets and economic growth…capital markets development generates economic growth, but the level of gross domestic product (prominently, per capita) also contributes to further capital market deepening. In addition, empirical evidence links capital markets and innovation, as well-developed capital markets play a key role in the financing of technology and, more generally, of riskier projects and enterprises, which are not usually financed via banking lending.”

For investors, emerging markets as a whole, which includes such countries as Vietnam, Egypt, and Romania, have come into focus in 2024 and have resulted, as the International Institute of Finance recorded in March, in five consecutive months of international fund inflows. There have been two reasons, the first being that global manufacturing companies are beginning to move production from China, boosting already good economic growth. The second, which benefits Georgia, is that cross-continental trade routes are diversifying, boosting the transit country economies. These two factors are forecast to drive faster growth across the small economies of Eastern Europe, the Caucasus, and Central Asia. Economic gains in these countries have already been outpacing that of many developed countries.

Georgia’s capital markets

“Georgia is considered a transparent and open market, especially compared to other countries in the region,” was the view of Stefan Weiler, Managing Director Central & Eastern Europe, the Middle East & Africa at the world’s largest bank, JPMorgan, when speaking to Georgian business news website BM.ge in Tbilisi in March for a TBC Capital investment conference. He added, however, that currently Georgia is restricted by the relatively small size of its markets, which limit liquidity. Development of scale would take time and the admission to Georgia’s markets of more and growing, local companies.

Yet, when asked how Georgia could find its niche, he said: “Georgia has already found its niche among international investors and this process started back in 2007 when the Georgian government issued the first sovereign bonds. There are investors who are interested in Georgia’s open market policy, transparency, proactivity, exchange of information, establishment of connections, participation in conferences…”

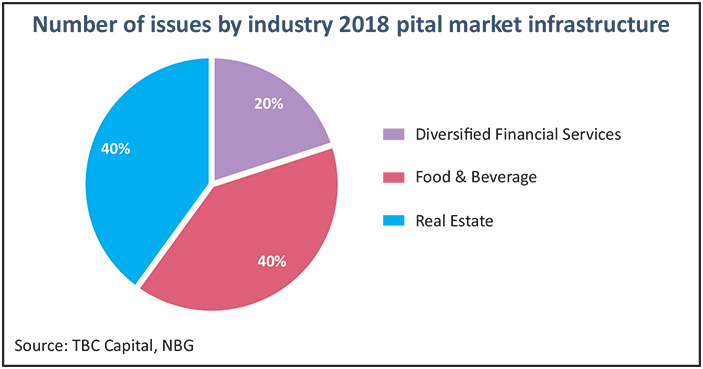

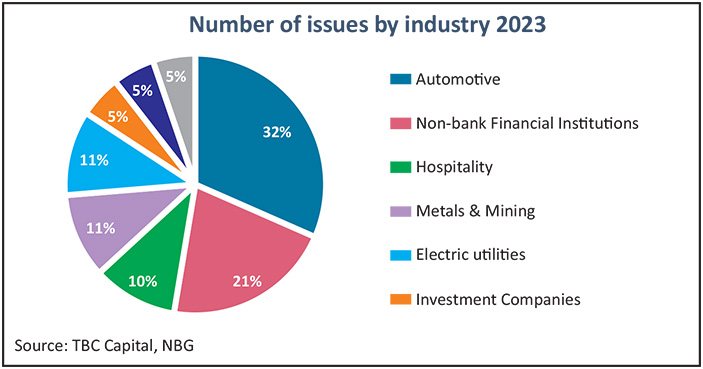

Currently, according to TBC Capital’s Market Overview issued in March, the rise in public transactions by issuers has taken the number to 11 issuers from eight industries, compared to five issuers from three industries five years ago. “Their primary objectives include refinancing existing liabilities (such as previous bonds and bank loans) with more favorable terms, optimizing cash flows…” Companies are seizing the opportunities offered by capital markets to refinance their bank loans on better terms.

While bond yields are public, major corporate loan rates are not, nor are the fees for either bond issuance or loans, and very often they are set after negotiations. However, when one of Georgia’s highest quality borrowers, Georgia Capital (which can obtain the best rates going) announced a refinancing last September through an 8.5% couponed bond, it gave some indication of the loan-bond cost gap when it said it was securing a “quite attractive rate when compared to the local interest rates in Georgia…the current central bank refinancing rate is 10.25%.”

Analysis of investment participation in Georgia’s markets released by TBC Capital at the conference also showed how the markets are developing with a shift in the dynamics – the traditional domination by commercial banks is being gradually replaced as private investors enter. “In 2023 alone, resident individuals accounted for 20% of investment activity,” it said. “Furthermore the increase in interest from non-bank financial institutions and international investors underscores the growing confidence in Georgia’s capital markets as a viable investment destination.”

The split in 2020 in the U.S. denominated bonds take-up was 53% from non-residents with residents taking the remainder, but as of 2023, this had diversified with 20% for residents, 30% non-resident, and 38% from financial institutions – with the rest held by local banks. In GEL bonds, the split had changed from 2020’s 100% being bank holders to 74% banks, 14% resident individuals, and 10% financial institutions.

There has also been change in the local corporate bond market from the demand side, according to the observations by TBC Capital on the issues with which it has been involved. “In 2019, there were only 12 primary issuers, predominantly comprising a concentrated group of large scale investors, reflected by the average ticket size of $185,000,” it states in its Capital Market Overview.

In 2023, the numbers of large investors reached 321, reflecting increasing interest. “More individuals are opting for (investing in) bonds over bank deposits, and more international financial organizations are investing in local corporate bonds,” it adds. Georgian Eurobonds are mostly bought by international asset managers, commercial banks, and government organizations.

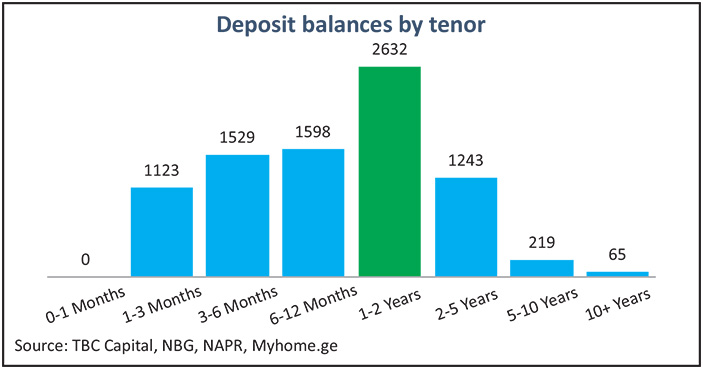

Reflecting the preference among Georgian investors for short time horizons, a large proportion of Georgian bonds have a one to two-year term. To lengthen the bond terms and the average size of the issues, says TBC Capital, “…it is crucial to attract foreign institutional investment into the country.”

However, TBC Capital found that there had been “growing confidence in the capital markets,” a significant development for Georgia in its quest to develop its primary market and enhance liquidity in the secondary market. Yet, pivotable would be “initiatives aimed at enhancing market accessibility, regulatory integrity, and investor education.”