How did the country’s largest exports cope in the first year of the pandemic?

Global Covid-19 restrictions both dampened trade in Georgia yet simultaneously spurred on the export and production of a few lucky commodities in 2020.

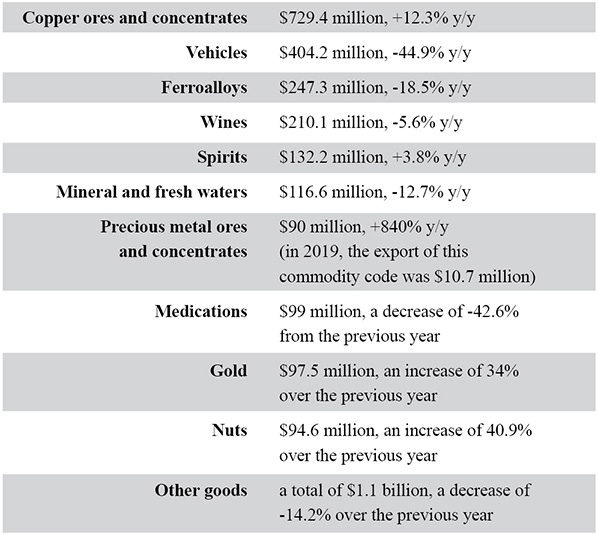

According to preliminary GeoStat data for 2020, the value of Georgian exports decreased 12% compared to the previous year and amounted to $3.34 billion. However, export volumes only decreased for five of the ten largest exports. Investor.ge looked into some of the largest categories of exports to try to figure out what was pushing markets up or down.

Pharmaceuticals

President of the Pharmacists’ Association Levan Gogoberidze told Investor.ge in an interview that he attributes the sharp drop in the export of pharmaceuticals primarily to the closure of borders because of the pandemic. According to Gogoberidze, most manufacturers export these goods by air, and the cancellation of flights delayed shipments.

“Raw materials needed for the production of medicines are imported into [the] country. During the pandemic, imported raw materials became more expensive, hence the producers made their products more expensive, and this was one of the reasons why producers had problems with their exports, due to the increase in the price of products. In particular, customers were naturally no longer happy to buy expensive medicines and sought substitutes,” Gogoberidze also pointed out.

The result: instead of focussing on export markets, demand for locally produced medicines made many companies pivot to meet local market demand.

Vehicles

As for vehicle exports, according to the annual report, re-exports of cars from Georgia were almost halved, with a decline of $329 million. In addition to the pandemic, the loss of a major export market had a negative impact on this sector. Until 2020, the main export markets for Georgia were neighboring and regional countries.

One of those countries, Armenia, was taken off the list in the beginning of 2020, since fairly high Eurasian Economic Union tariffs have been introduced in the neighboring country, and car exports from Georgia are no longer profitable.

Caucasus Autoimport CEO Davit Gulashvili says that the change came as no surprise to businesses, and that despite the pandemic, demand for used cars has not diminished, but supply has fallen, leading to higher car prices at auction:

“The number of items for sale at used car auctions has reduced . For example, we are representatives of Copart, and while before there were 300,000 cars at auction, now there are 150,000. That is, the demand in the world has remained the same, but there are problems with supply. Therefore, the cars sold are more expensive , which also pushes sales down.”

Gulashvili says if Armenia is subtracted from the total re-export of cars, there was even some good news this year: sales to Azerbaijan were up. In his opinion, a complete replacement of the Armenian market may not be possible, but after Azerbaijan and Ukraine, new players have appeared on the market, which raises optimistic expectations for businesses.

“Along with all this, new markets are emerging, which is also surprising to us: Moldova, Iraq, (which have never been seen on the radar before), and now cars in these countries are flowing very steadily for re-export. If growth in these markets continues at least slightly, we should assume that when supply resumes, it will quickly return to the levels it was before. A vacuum has been created in the market and this vacuum must be filled quickly,” said Gulashvili.

Nuts

Demand was down for hazelnuts this year, but the nut industry did better than it has in more than five years: Georgian hazelnut exports, for example, were up 40.9%.

Hazelnuts have been part of the ten largest export commodity groups for years, and are one of Georgia’s most prized crops. In recent years, hazelnuts have faced plant disease and devastation wrought by the brown marmorated stink bug, but government and farmer intervention seems to have the industry back on the mend.

Levan Kardava, Executive Director of the Hazelnut Processors and Exporters Association of Georgia, commented on the sharp increase of exports during the pandemic: “The harvest was much lower in previous years and the export rate was derived from this. Of the last five years, we have had the best harvest this year, but I would like to point out that in 2020, demand for nuts from EU countries has decreased. About 80% of our export orders come from EU countries, with the rest coming from Russia, Ukraine and Asia.”

Kardava says that the epidemic thankfully did not affect the production of hazelnuts and did not hinder work – only the rules that were necessary due to safety norms were changed.

Ferroalloys

Ferroalloys also took a hit, exports of which had been growing steadily up until 2020 when they dropped 18.5%.

Gold

Gold

One reason behind the decline in exports is due to the decline in demand on the world market and a general rise in the global supply of ferroalloys.

Another factor has been a slow pivot in the approach to the production of ferroalloys in Georgia:

“Rising prices for raw materials, as well as rising prices for electricity, have led us to begin to look for alternative production methods. But we have been producing less with the new technologies, and this has led to a reduction in exports,” said Nugzar Kevlishvili, General Director of the Ferro Alloys Producers and Manganese Miners Association.

Not all metals suffered. Gold exports experienced a fairly large increase compared to the previous year as investors poured their money into gold over fears of the lasting effects of Covid-19, RMG Gold Ltd, one of the largest exporters of gold in Georgia, told Investor.ge.

Wine and mineral waters

Wine exports have been dampened by the pandemic as well. Director General of the Acto Group Giorgi Egzubaia says the decrease in exports is related to the general crisis in the Horeca sector, which he says is more than 50% down YoY across the globe.

Mineral waters have experienced a similar fate. Tskali Margebeli, the owner of several well-known Georgian brands such as Nabeghlavi, Bakhmaro and Geo Natura, says in addition to decreased demand, they have faced issues with transportation as well.

____________________________ ADVERTISEMENT ____________________________